Community Update: 2024 Infor Customer Experience Insights

By: Richard Leigh Stout February 6, 2024

Over the last month, RPI Consultants conducted an extensive survey gauging the overall attitudes and experience of professionals using Infor ERP systems.

The State of Infor Community Survey asked a series of questions, including which Infor systems users deploy, their cloud-migration plans, and where Infor can improve its services and applications the most.

Our goal with this survey was to better understand the Infor customer experience so that we in turn can build a stronger, more responsive community.

After analyzing extensively and collaborating to identify meaningful insights, we are pleased to share the top Infor insights for 2024. For all the data collected from the survey, download our State of the Infor Community Infographic, or keep reading to see the major highlights.

Infor Functionality Sentiment

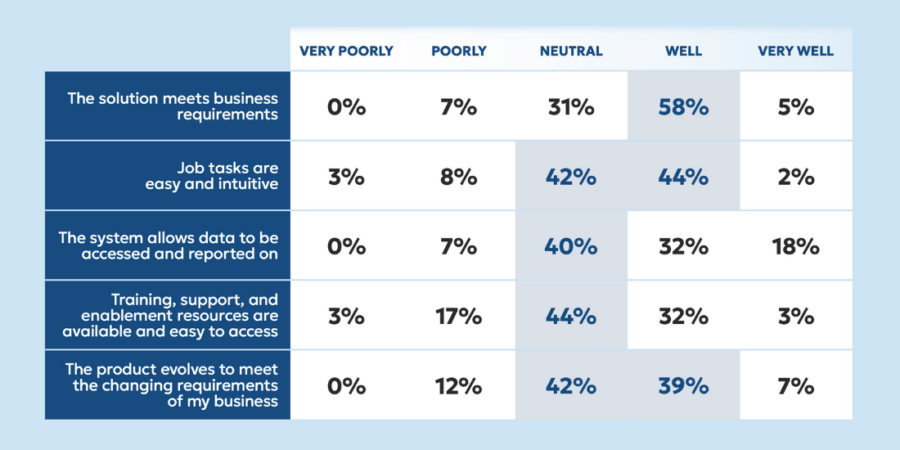

We asked Infor users about their overall experience using various applications and the ability to use functionality to carry out their job duties. This includes responses from IT, HR, Supply Chain, Finance, and other business users.

Here were their responses:

As seen above, the majority of survey respondents believe Infor’s functionality meets desired business requirements, with many describing carrying out job functions as “easy” and “intuitive.” A large percentage of respondents have neutral, or positive feelings regarding data access, training & support, and product evolution as well.

Overall, it appears users are pleased with Infor’s various ERP applications, both on-premise and cloud-based.

Infor System Usage

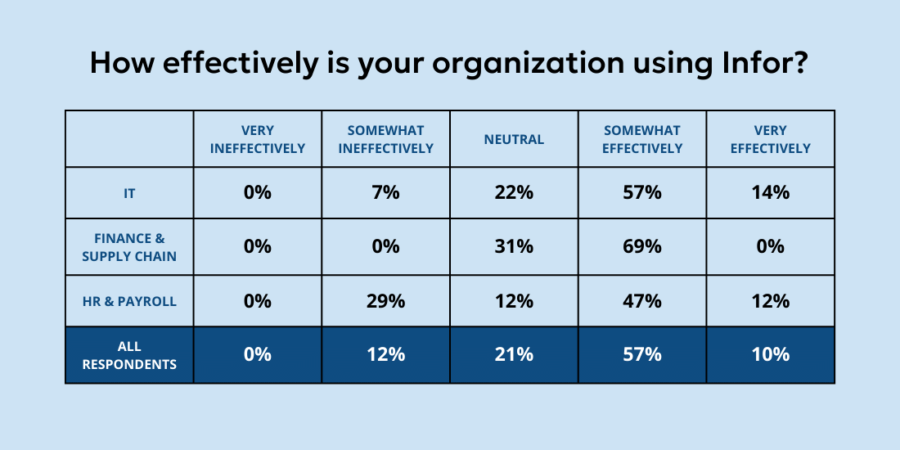

When asked how well users believe they’re using the Infor system, most believe their organization is doing so effectively, with nearly 70% saying “very effectively” or “somewhat effectively.”

After taking a closer look at the demographics for who answered this question, we saw that there was a difference in opinion regarding system use. HR users believe their business is using Infor less effectively than those who work in IT and Finance. We suspect this is why HR’s timeline for moving to a cloud-based solution is sooner, but more on that below.

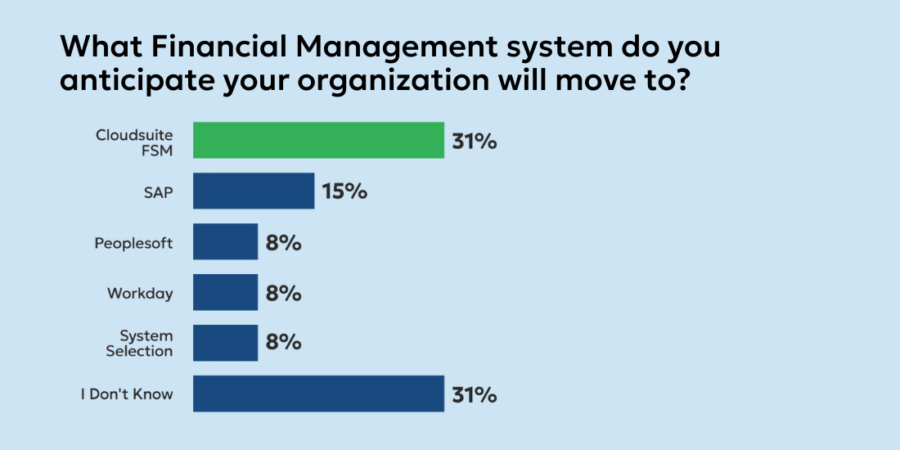

Financial Cloud Migration Plans

Our Infor customer experience survey also looked to understand users’ plans for leveraging the system going forward, including migrating to cloud-based systems, Infor-based, or elsewhere.

For Finance/SCM/IT users currently on Lawson Financials, only 8% are currently migrating to a new ERP system, while 46% plan to stay on Lawson for at least another three years. This is likely due to Infor’s extension of on-premise support to 2030.

Interestingly, of those respondents using Lawson Financials, nearly a third plan to stay with Infor and migrate to the latest version of CloudSuite FSM. And another third is unsure of what system they will be using for financial and supply chain operations.

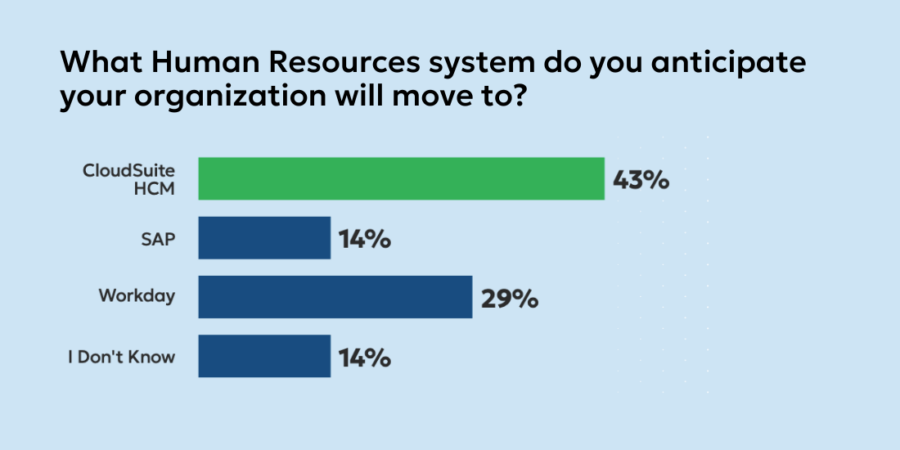

Human Resources Cloud Migration Plans

HR survey respondents had fairly different sentiments, when compared to their financial counterparts. Our data found that 29% of Lawson HR users are currently migrating to a new system, and a whopping 43% plan to migrate to a new system within the next three years.

For those on Lawson for HR, many respondents (43%) plan to migrate to CloudSuite HCM in the near future. Less than one third are planning on moving to Workday (29%), which is interesting when you consider that Workday has historically been a leader in HR applications and services. Perhaps, Infor, the up-and-comer, is carving more out of the market based on recent product developments and enhancements.

On the other hand, nearly 30% of HR professionals report that their business is not using the Infor system effectively, which would explain why this group is more eager to move to the cloud.

Workforce Management Migration Plans

Workforce management (WFM), a business area that continues to gain traction across a variety of industries, had perhaps the most interesting data. Nearly a third of survey respondents (31%), said they were using Kronos Workforce Central for their WFM requirements. Just 17% are currently using Infor’s WFM application and 7% are leveraging Kronos’ cloud-based WFM solution, Kronos Dimensions.

Of those actively using CloudSuite HCM or planning to migrate to CloudSuite HCM, 38% are using Infor WFM for workforce management. Which represents a large percentage of respondents, with Kronos Dimensions and Workforce Central making up another 38%. This appears to be another area where Infor is carving out more of the market and is likely due to recent product developments and support.

Drivers for Exploring Different ERP Solutions

For respondents who said they planned to migrate off Infor Lawson to another ERP, we asked them to identify the reasons why they were leaving.

To find out the top drivers for looking outside of Infor, as well as other key insights, download our State of the Infor Community Infographic below.

About RPI’s Survey Respondents

RPI Consultants’ State of the Infor Community Survey was conducted between December 20 and January 12 and polled Infor users across various industries and departments. Roughly 59% of respondents were from healthcare, 23% from the public sector, and the remaining 18% was spread across a mix of industries.

In terms of department and work function, 44% work in IT, 21% in HR, 19% in finance, 8% in supply chain, and 8% in other business functions.

Follow us online for faster access to announcements, knowledge base updates, and upcoming events!