Lawson Lease Management

Join RPI while we present this Lawson Lease Management webinar. Learn how this integrated Lawson module can assist with the management of your organization’s Leases. This webinar will cover functionality, including lease maintenance, payment schedule setup, straight line payment calculation & accounting, and regulation compliance for capital leases. See the payment cycle process from LM payment schedule through invoice creation and interface to AP. Compare the option of LM to maintaining recurring AP invoices, as well as externally managed options.

Transcript

Keith: I want to thank you once again for taking the time to attend this morning’s presentation on Lawson Lease Management. We have a great presenter here for you today, Mr. Chris Gordon. First, a couple of house keeping items. One is, we will be recording this session. We get asked that often. It takes a little while to edit it, get it ready, get uploaded to YouTube. Give us a week, week and a half. We will send you an email, my good friend Logan here, when it is ready. So you’ll know you’ll be able to share that, you’ll be able to rewatch it. Hopefully it’s worth rewatching. The second is, these presentations, we’re talking straight into a camera. Questions are super helpful, so if you have some please type them into the go-to webinar module and Bill Getty will ask throughout the presentation. Helps break up the dynamic a little.

Now, without further adiue, I give you one of our most talented financial consultants, a colleague and great friend, Mr. Chris Gordon.

Chris Gordon: Thank you Keith, and thank you guys for joining this morning. Like he said, my name is Chris Gordon and we’re going to spend the next hour or so going over the Lawson Lease Management module. We’ll look at some key functionality, I’ll go through an actual product demo. So, we’ll show you how the the Lease Management module works and how it interfaces with some of the other Lawson modules. The Lease Management module is something out there that a lot of you guys may or may not have set up. A lot of times, Lease Management kind of gets kicked to the back burner. You own it but you don’t have it implemented and you might be asking yourself, “What are some of the values that we can get from this system today?” That’s what we’re trying to answer. We’re going to hopefully, over the next hour or so, show you why this is a valuable tool to implement.

Like I said, we’re going to start with the functionality overview of the Lease Management module. What are some of the processes it replaces? If you’re doing a lot of calculations or journal entries outside of Lawson and interfacing into Lawson, what does this Lease Management module replace for you? Who’s the product for? Who should be considering this product? There are certain economies of scale that if are met, this module is a valuable tool for you and we’re going to go through that in the next few slides.

Like I said, we’re going to do a product walkthrough, so we’ll show you how the leases are set up, how their interfaced as an Accounts Payable system, and eventually paid through AP. We’ll touch on some reporting and analysis because after all, this is a module within your Lawson ERP and what good is it if you can’t report out of it?

Some new lease requirements. We’ll go over … Starting in 2019 there’s some new standards for lease accounting that I do want to touch on towards the end of this presentation.

Like we mentioned before, Q and A. This is reserved for the end, but if you have questions throughout the entire presentation, type those into the GoToMeeting and we’ll stop and address those.

First and foremost, a little bit about RPI. This is actually a picture taken from Inforum back in July at our booth. RPI was founded back in 1999. We’re located right here in Baltimore, Maryland with other satellite offices in Florida, Arizona, and Kansas City. We have about 70 consultants nation-wide, certified across all the different Lawson products.

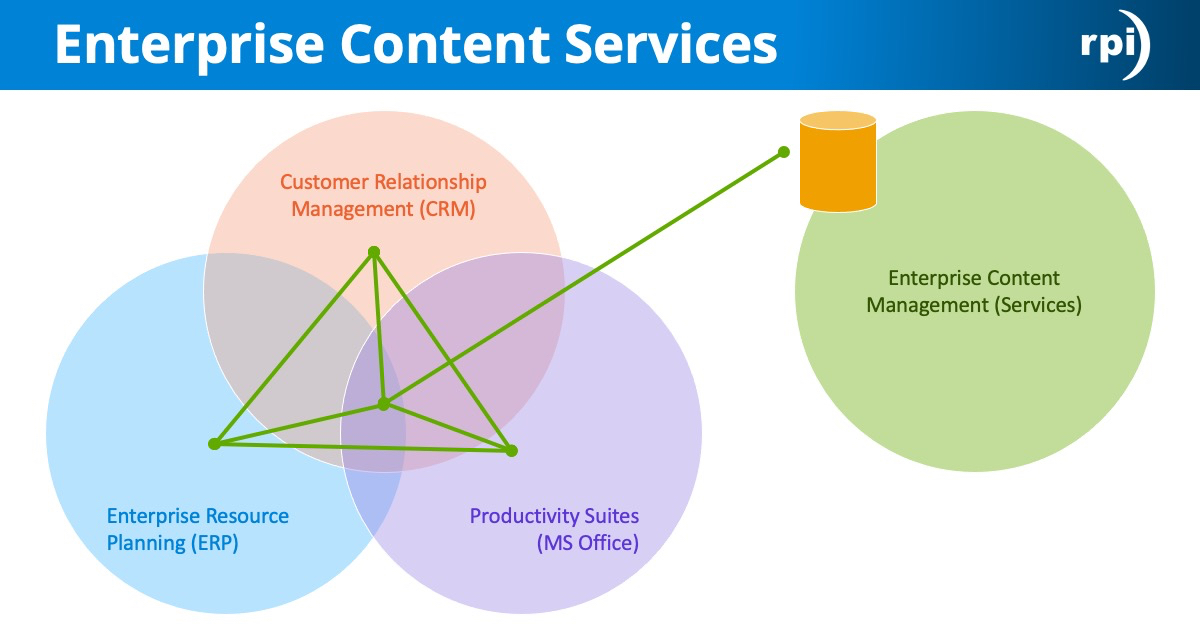

A little bit of a functionality overview. If you’re new to Lease Management and curious what it does, let’s just give you an idea of why it might be valuable to implement Lease Management and show you what it can do. First and foremost, it’s an integrated solution, right? Just like AP is integrated to your General Ledger. The Project Accounting module is integrated to your General Ledger. The Lease Management module follows those same rules. It’s a sub ledger to your General Ledger and allows you to automate the process to account for, analyse and report on and pay both operating and capital leases. Like I said, it’s integrated with Asset Management. If you have capital leases, you have those set up in your Lease Management module as well as in your Asset Management module. There is that connectedness between Lease Managment, LM and Asset Management, AM.

A really good benefit from the Lease Management module is this integration with Accounts Payable. We’re going to go through a whole product demo in a little bit, but just know that the LM and AP integration is very strong and very powerful and that’s what makes the Lease Management module a really nice system to use. Of course, it’s within your Lawson ERP, so it’s integrated with your General Ledger. There’s also ways to capture activity, account category costs on your invoice lines and interface those into the Project Accounting module, too.

All right, so some key functionality. Starting from the ground up, you define and maintain your leases in this Lease Management module. That’s the whole point of it. You set up your leases, you define your payment schedules – that’s the second part here – you manage your rents, your lease payments, any other related recurring costs associated with that lease, right? In addition to that monthly recurring payment or semi monthly, or quarterly, or however often you have to pay those lease payments, there’s the ability within the module to tag these recurring costs onto that payment schedule. You’re paying the monthly recurring payment, but you’re also paying maybe a CAM or an insurance payment in addition to that monthly cost.

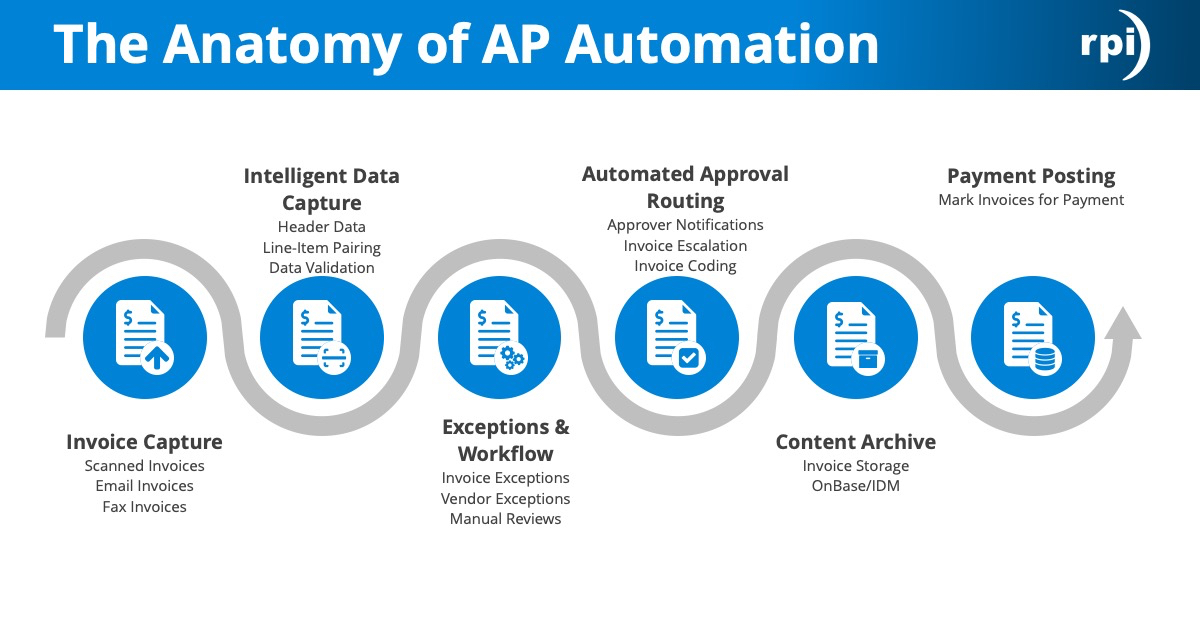

The Lease Management module also creates those invoices and interfaces those into AP, like we said. There’s a semi … It’s not a routing process for approval, but you do need to have an authority code on your lease invoices and those invoices can’t be interfaced into AP unless someone approves them. There is that control there between the Lease Management system and AP.

As we go through our demo, these terms I’m throwing out are going to make more sense. The due dates on your payment schedule are used to create the invoices. There’s a program that runs that looks at your payment schedule to see what’s scheduled and what should we pick up to actually pay. All that is, again, maintained within your lease and under the payment schedule. Obviously the Lease Management module creates your journal entries that are interfaced with the General Ledger to account for operating leases as well as capital leases.

What’s nice is that the module itself … You define your payment schedule for the lease and it allows you to adjust those payment amounts over the course or the term of that lease. The demo that we have is going to just show a $500 monthly payment, but just keep in mind you can set up those payment schedules exactly how your lease is scheduled. If there’s a 3% compounding escalation or escalator year over year, you can add those into your payment schedule. You can make those payments varying on your lease, but you can … At the same time, if you need to expense that lease straight line over the life or term of the lease, you have that ability too. In a couple more slides we’re going to go over how you actually split out or make that lease a straight line basis or a straight line expense lease.

Date codes. These are nice. These are kind of tag on to your leases that allow you to mark specific milestone events or specific dates that you need to be aware of for that lease. They’re user defined. A good example is a renewal for a lease. Three years into a lease and the … In the contract it’s baked in to say, “A month or two the lease expires, let us know if you want to renew that lease.” You can tag your leases with these codes and eventually report off of those codes to give you an idea of when you have to make contact with the vendor to, in this case, renew a lease.

Here’s an example of where we’re putting these codes on. This is LM21, this is our lease. On our dates tab we have the ability to put as many date codes as we want. In this case I have an EXP date code, which is just saying, “This is our release renewal code,” and I’m saying that this lease needs to be renewed or we need to let the lessor know when we want to renew this lease by June 30th of 2020. The lease actually expires, I think, July 30th of 2020. One month before the expiration we need to let the vendor know if we want to renew.

There’s a report, right? You put those codes on there. That’s great, but it’s not really beneficial unless you can report on that. The LM207 is that date code listing. The name of the report sounds like it’s just a listing, but you can actually include leases. If you click that off to yes, it’s going to report on that date code, but it’s also going to bring in any leases that have that date code and give you those dates that are associated with that specific date code. Just some helpful things in there for you to maintain those leases and kind of be kept informed on when specific dates are coming up so you can act accordingly.

Here’s just a screenshot of what the report looks like. We ran it and then we see we have four leases out there that have this lease renew code on there. I can see that the dates of when those need to be renewed right on the report. Maybe this is a report that you run every month during your close just to see what’s coming up and make contact with the vendor when necessary.

What does the Lease Management module replace? Maybe some of you on the meeting here are doing your Lease Management outside of Lawson on a spreadsheet. You might be thinking, “All right, Lease Management sounds nice but what am I really getting from it? What is it replacing that I’m doing currently and how can it add value to my day to day?” Here’s some key features that the Lease Management does automatically.

It’s going to perform that FAS13 classification test to say whether or not this is an operating lease or a capital lease. We’re actually in the next slide going to get into the details of that FAS13 test. If you have capital leases, it’s the integration between your capital leases and your Asset Management system; so you can set up a capital lease as well as have that related to an asset in your Asset Management system and let Lawson account for and create all those necessary journal entries that you need to make.

We’ve touched on the payment schedule a couple of times, but a big thing with this, if you’re not managing your leases in Lawson, AP when it comes time to invoice for a lease, they might be going off of old data. They might be paying an invoice for a lease that has changed. The Lease Management module allows you to maintain all that information in one system and AP is not really worrying about what’s being paid. They’re just taking that information from the system and paying. We have all those due dates set up in there. Again, you might miss a payment. AP could easily miss a monthly lease payment, but if you have this system integrated, those due dates are there and you make this part of your month end process and you’ll never miss a lease payment.

I think we have one question.

Speaker 3: Hey, Chris. We have a question here. Is it possible to tie Lease Management into Lawson Contract Management or even PO25.7?

Chris Gordon: Into Contract Management? I don’t think so. PO25.7, I don’t know that form off the top of my head. Is that just a vendor?

What’s driving that question?

Speaker 3: If you type in what’s driving that question into your thing, if we don’t address it today or in the session, we’ll research that and get it back to you.

Chris Gordon: Okay. Is that it for questions right now?

With those capital leases, there’s a program in Lease Management LM180 that’s going to create those interest entries. It’s going to automatically calculate interest for your leased assets. You’re also allowing Lease Management now to generate invoice numbers based off of certain criteria that we’re going to get into. Just know that these invoice numbers can change if you have version 10, there’s the option to adjust what Lawson is saying that invoice number should be to maybe what the vendor is saying that invoice number is.

We kind of mentioned this before, the invoice routing. I don’t want you think there’s a built in approval mechanism within Lease Management, but every invoice needs an authority code. There is some sort of routing for these invoices to be approved before they are paid. You can kind of take that … Maybe all that is happening out side of the system of record. You can that incorporated into your Lawson ERP.

All right, I don’t want to get too deep into this, but this is kind of a breakout into how fast FAS13 is being calculated. We’ll just kind of go briefly into this. You see at the very end here, we have a breakout between a capital lease and an operating lease. Different factors are driving how that lease gets classified. The first thing it’s looking at: ownership transferred at the end of the term. If that’s happening from the lessor to the lessee then that automatically classifies the lease as a capital lease.

Same thing if there’s a bargain purchase option. If there is, then that’s going to be a capital lease. The land is greater than or equal to 20% of the fair market value of the asset, that that’s going to drop into an operating lease classification. If the start of the lease term in the last 25% of the asset’s life. The answer to that is yes, that’s going to make it an operating lease, too. The lease term is greater than or equal to 75% of the remaining life, that’ll automatically categorize it as a capital lease. Then all in here we have some discount rate calculations and then Lawson is going to look at the present value of all the minimum lease payments and if that’s greater than or equal to 90% of the fair market value of that lease, then that’s going to put it into the capital lease bucket. If not then, it’ll be an operating lease.

Now, that’s what Lawson is doing behind the scenes. This is maybe something you’re doing now outside of Lawson in a spreadsheet. As you add your leases, this is part of the lease addition process. You need to classify that type of lease.

What about a straight line or a deferred rent situation? Where maybe your monthly payments are varying each month, but you’re required to expense that lease straight line each month. Those expenses need to be the same over the life of that lease. Well, Lawson can handle that. On your lease if you need to set up a deferred rent account, that’s off of … We’re going to get into … The product demo kind of goes through every one of these tabs. We’ll need a deferred rent account set up first for this type of process. On the payment schedule, we’re going to need to indicate via that straight line flag that it’s going to be a straight line amortised or expensed lease.

Then, your LM131. That’s the invoice creation program that’s going to create the invoice and it’s going to create the expense and the deferred rent distribution. That’s why we need that deferred rent account populated on the lease itself. AP pays the invoice. There’s also the option to override that straight line amount. On the lease, Lawson is going to add up the sum of the lease and divide it by the total amount of periods there to give you what that straight line amount should be. If, for whatever reason, you need to override that amount, you can come into this LM30.5 to override.

All right, so, is Lease Management for you? There’s a couple of questions here that I think … You might be liking what you see but we kind of want to get into the value of Lease Management and go through a couple of questions to get you thinking about whether or not this might be a good fit for you.

First, we have a question.

Speaker 3: Can you elaborate on exactly what the authority code is (for approval) and how that process works?

Chris Gordon: Yeah, sure. The authority code, if you’re familiar with AP, it’s the same authority code or same type of feel that you’re putting on an invoice to release that invoice for payment. The authority code is, it’s an AP setup that you’re now putting onto an invoice. The authority code is probably going to be a manager within that lease department to make sure that those leases, the payments, are accurate. Essentially, it’s just a way to tag a person to an invoice payment and have that person via LM36, go in and actually approve that invoice before it gets interfaced to Accounts Payable. The set up is actually done in AP. If you have AP you’ll just have to add another authority code or two or three or however many approvers you have, to accommodate the Lease Management module.

Okay, so just a couple of questions to get you thinking whether or not Lease Management is a good fit. Do you have a lot of leases? If you only have 5 or 10 leases, it’s probably not worth the effort to go into implement a whole module. There’s no one stopping you from doing so, but Lease Management is really geared toward those organizations with hundreds, even thousands of leases. Where the maintenance of those and the ownership of that process is hard to maintain. Having a system to do it for you in addition with some full time employees is a benefit there.

The capital leases with the FAS13 requirements. A lot of that work might be done out of Lawson on a spreadsheet, so getting that type of integration with Lawson and having Lawson doing some of that for you will save you some time. Same thing with the straight line calculations. Let Lawson do that for you. You might be doing manual journal entries if you’re doing straight line depreciation outside of Lawson and having to interface those into Lawson. Setting up those leases, defining whether they’re straight line or not and let Lawson do all the calculations for you is a benefit.

We got one question.

Speaker 3: When you make a change in the straight line expense schedule and it changes the straight line expense, can you explain how the straight line override entry would be calculated?

Chris Gordon: Well, the straight line override is not a calculated field. If I understand the question correctly, it’s a field that you’re going into to override what Lawson has already calculated as what should be the straight line. The straight line override is you going in to say, “Oh, Lawson said it should be $450 a month. It should be $445. Or I want it this time to be $475.”

Speaker 4: Sometimes that might be used if a lease is partially elapsed when you’re first putting it into the system. It would calculate it erroneously because Lawson only has the remaining payments. It’s more of a manual override for exceptions. Then future payments would be calculated, the delta, over and under that, but you can put in that manual override straight line calculation amount even if that’s not what the history in the LM module really represents. If that makes sense.

Chris Gordon: We touched on this before a little bit. The manual processing of AP processing these lease payments. Why not take that burden off of AP and have someone maintain those leases and the payment schedules and Lease Management? It’s easy for AP to miss a payment. Not anymore if you implement Lease Management and you have LM140 feeding AP what those lease payments should be. Same theme here, too. If you have a varying lease payment, AP might not be aware of the most recent payment. If there is a change year over year, or quarter over quarter, that might be hard for AP to keep up with and maintain. Especially if you have hundreds or thousands or leases. Having this ability to define your payment schedule within Lease Management and maintain those payments there is a benefit.

Last but not least, we talked about it before, but spreadsheets. If a lot of this work is being done on spreadsheets, capturing that in an ERP that you already have integrated with your General Ledger and Accounts Payable is a benefit, too.

Over the next 15 or so minutes, I want to walk through a little product demo. Basically, we’re going to look at a lease that’s been set up. Go through some of those tabs that we’ve seen a little bit so far today. Talk you through some of that and then eventually pay one of those lease payments and show you how that process works, how that invoice gets approved, interfaced into AP and eventually paid.

Again, this is kind of just a flow chart here of what I just said. In the green we’re just going to review what the lease looks like and then the blue, we’re just going to create the invoice, approve it, adjust it if we need to, and eventually post it and calculate interest within the Lease Management module.

Here is a lease we have out there. Just a little bit of background, company one, lease one. It’s a car. We’ve leased a car for three years. We’ve already run the FAS13 test so you can see that it’s been classified as a capital lease. We’ve given it a user defined type of vehicle. Those types, if you’re familiar with Asset Management, you can define those types, too. We have vehicles, office space, building, land. However you want to set up your types, that’s up to you. We have the term of the lease. We have the start and end date. We have the total life and remaining life of that lease there, too. Also, that ownership flag. That was, remember, on the FAS13 calculation, one of the first variables or factors that that test took into consideration – are you going to own this? Here, we’re not. We’re going to give this car back after three years.

Let’s walk through some of these tabs here. We’re going to take a look at amounts and land, some payments. Just keep in mind this lease has already been released. It’s a little bit different than if we were just adding it right now. Let’s look at the amounts and we’ll pause it right here for a second. What we’re going to do is … It’s an embedded video, so we’re trying to sync up with this. We’ll pause it at our amounts. If you have a down payment for the lease, if you have a security deposit for the lease, if you have a bargain purchase amount for the lease, too, remember that’s another one of those factors the FAS13 calculates. This is where we’re entering all that information.

We can move onto the land tab. Essentially all you’re saying is, is this land? Is it land or building? If it’s neither than you an just kind of skip this tab. You have options to put in that value for your land and land value.

We can move onto the payment tab and that’s really where a bunch of detail is going to be set up here for that lease. Okay, we’ll pause it here. Here is where we’re saying who the lessor is. This is going off of our vendor master. In this case, LA Police Gear has leased us this car. We’re making 12 payments a year. We’re going to be making these payments at the beginning of each period. We’ve identified our first payment date. It’s a capital lease so we have an interest rate that the lessor has given us there. We’ve identified our debt or our expense account and we’ve identified our interest account. That’s required. If it’s a capital lease, you need to have you interest account populated.

Last but not lease, the invoice prefix. The invoice prefix is a user-defined field that is going to get tagged onto the invoice. When this invoice gets created, it’s going to start with LDRE and then a number after it. 0001 for the first payment. This is 16 characters long. You can make it whatever you want, it’s just a way for you to identify that invoice. There’s a lot of other accounts here, too. Remember the deferred rent account, if we are doing that. That straight line accounting, we need that information in there.

Executory costs. We’ll take a pause here for a second. Executory costs are a way for you to add related or recurring additional costs to that payment, or to that lease. You have a three year lease with payments being made each month, but you also have additional costs. Maybe an insurance cost or a CAM cost associated with that lease that needs to get paid as well. You can set those up to, if it’s every single month you need to pay those executory costs, you can set it up that way. If it’s quarterly or every other month, you have the flexibility within the system to set that schedule up however you need to.

Again, you can kind of see where the activity account category fields off to the right come into play. Pause it here. Like I said, Lease Management integrates with AC. If you needed to tag these invoices or leases to activities, you have that option. We’ve already run the FAS13 test. It’s been classified as a capital lease. We see that information here. We also see Lawson’s given up a net-present value of our lease at $28000.

We’ll move on to the dates tab. This is just going to give us the ability to add as many date codes as we want. We saw this before in the beginning of the presentation. We have our lease renewal out there. We have a date associated with it. If there’s any other dates that you want to put in here, whether it be for reporting or just for analysis or to alert you of something, you have as many fields as you need in there to do that.

We’ve entered our lease, we’ve released our lease, we’ve run through the lease calculation, and now we’re going to look at the payment schedule. The button at the very bottom is going to take us into the payment schedule LM30. This is where we’re setting up. In this case, month by month what our payment amount is going to be. When are those invoices going to be due? That’s where our authority code comes into play, too. We had that question before. You need to tag an authority code on every one of those payments so we know who’s responsible to approve. The dates are what’s driving the next program, LM131, to create the invoices. Those due dates will get picked up based on the parameters of our LM131.

This is just another way to look at it. You can make these recurring payments here. Instead of, if you have a three year lease, you don’t want to have 36 rows that you’ve got to type out manually. You can just type those in directly to one line, say recur for 36 times and Lawson is going to burst that out into what you see here.

That’s the lease, right? You build it and you identify or define those payments. In this case you only saw the $500 a month as the lease payment. In our next demo we’re going to look at, what if there are those executory cost codes? We’ll show you what that looks like.

LM131, this is our invoice creation program. Like I said, we’re picking a due date to say, “Include any invoices up to and including this date.” That’s going directly back to that payment schedule. The invoice date here, so this is important, that’s going to be the post date when this gets interfaced to AP and AP175 eventually posts the payment.

I’m going to run the report. I’m going to check my print manager to see what’s been picked up based off my parameters. It’s just going to be the one lease out there. I think I ran it for just company one, lease one. This, remember, is our invoice prefix. The LDRE. Then it assigns a payment number right after it. The next step would be to go to LM31 if you needed to adjust anything. What LM131 does is not final, you can always come to LM31 to make adjustments. We’re still in an unapproved status. That’s important. This has not been approved yet. This has not been interfaced. We inquire on our payment number. We see this is our debt, our expense account that we’ve defined on the lease back on LM21. In this case, I want to change my invoice number to match what the vendor is saying the invoice number is going to be. They have the invoice staring LDRE 988400. I can make that change here and now Lawson and the vendor’s numbers match up. Again, still unapproved. Make any changes you need to before that invoice gets released. Or gets approved.

The next step, there’s two different options. You can go to LM36 to release that invoice one at a time. That’s what we’re going to do here. We inquire on our company and authority code. It’s important to have that authority code or else you’re not going to get to that invoice. You have the option to change or approve and interface to AP. In this case, I’m just going to make the change here and then I’m going to show you the interface program to run after. You can also do both at the same time here. You can actually approve it and say, “Yes, interface to AP,” all at once. Two options. I chose the first. I’m just going to release one and show you the next program.

If you got a whole bunch of invoices you don’t want to do this one at a time, right? You’re going to want to come to LM136, which is the mass payment approval and run a program to approve any different types of leases. You can do it by company, specific lease, lease classification, or if you want to include different lease types you can run this mass payment approval program.

Okay, LM140. That’s the big program that interfaces those lease payments from LM to AP. Bunch of different parameters here. I’m going to just do company one, lease one through my invoice state. This would be I think November 1st for whatever that last invoice date was. Nothing is in AP yet. Everything is still living in LM until this LM140 runs to bring over those released and approved invoices to your AP system. Once this runs, it’s going to bring a released invoice record. You’re not going to have to go in and release this again in AP. It’s just going to come over as a released invoice, ready to pay. You can see our new invoice number here, too, that we changed it to.

Nothing too fancy here on the output of LM140. You just want to check it to make sure there are no errors and everything got over to LM. Real quick, we’ll go to AP30, inquire on that company, the LA Police Gear vendor, and we’ll see that our invoice has made it over there. It’s ready to pay. It’s on AP30, so it’s been released and it’s now ready to pay.

Now, since this was a capital lease, one of the next steps is to run the LM180 to process the interest calculation. We’ll come back here, run LM180 to do that. What we’re going to do at the very end is just look at an LM90. An account balance or a lease invoice balance report. Just to show you … Kind of wrap it up to give you an idea of what types of inquire screens you can go to to see some of this data. All right, so LM180 runs. You only need to run it if you have capital invoices. Operating invoices don’t follow this. We can see our interest amount here for $45 and our principle for $454, and our debt and interest expense accounts debited and credited.

LM90. LM90 is just like a GL190. You’re posting transactions, in this case, that originated within the LM sub system to keep your LM reporting and analysis up to date. We’ll run LM90. It’ll post that one invoice that we just paid, and then we’ll take a look at LM90. Our payment amount, our principle and interest amount – just one invoice here. You can click on these links here to bring up or do a drill around from the report itself. Let’s just shoot out to LM90 to wrap it up and we’ll just inquire on this lease and show you what’s been posted. I think we actually have a little bit of history from before. We’ll see more than just that one invoice. We have our invoice date of September, October, November. On a posted status and you can see that the interest has been calculated for all three of those. It’s kind of just a quick front to back of that process and how you can, again, at the very end go back and see what’s been done.

We just showed you a little demo about a pretty straight forward lease with no executory costs or other types of payments that need to happen throughout, and it was also just $500 over the course of three or five years. Lawson can totally handle any adjustments in lease payments throughout the term of that lease, and it can also include any executory costs or additional related costs that you need to add to the lease.

Back on LM21 on this lease, we have an office space lease and we have CAM and insurance that we need to pay. We’ve defined that on the lease. This screen should look pretty familiar. We just saw this before our LM30.2. Where we go in and say, “All right, we want to have 60 payments of CAM and 60 payments of insurance happening at a monthly frequency.” You can set that frequency to weekly, monthly, semi annually, yearly, quarterly. You have flexibility there. We gave it the same authority code. Then you define the amounts and when the due date are for those payments. Okay?

What about varying payments? You can totally go in a change the amounts. In this case, 2015 was a 500. 2016 we have a 3% escalator to bump it up to 515. From 2016 to 2017 we have another 3% escalator to bump that from 515 to 530. You see how this schedule is maintained, right? You can vary those payments throughout the life of the lease and make any changes that you need to.

Question.

Speaker 4: I think a pertinent question that might have just been partially answered, but I’ll read it in detail here. How are non scheduled lease amendments handled? Say lease payment schedule adjusts in year 5 of a 10 year lease, can you direct Lawson to book the catch up entry in a certain month and going forward?

Chris Gordon: The answer is yes. Would we recommend doing an added line on that recurring?

Speaker 4: Right. If we know before hand then we could just adjust the payment schedule on that recurring schedule. Say, it’s not escalating currently. You can end, after 5 years, put in another payment schedule going forward after the 5th year with the increased amount. If for some reason we didn’t catch it, you could put a one time payment in there for the catch up and then adjust your go forward recurring amounts. Hopefully that answers it. Feel free to follow up.

Then the second question here, which unfortunately I think the answer is no. Can this be used if purchase orders are in place and need to be matched?

Chris Gordon: Are you asking for a link between a purchase order and a lease?

Speaker 4: I’m guessing so. If perhaps their policies are such that they would create a PO for your car lease. Because somebody needed to approve that you were leasing a $100,000 car.

Chris Gordon: I don’t think there is a way to link a purchase order into the Lease Management module.

Speaker 4: Yeah, I think everything just comes over as an expense invoice, and I’m not aware of that ability either.

Chris Gordon: It’s an older module, so there hasn’t been too many updates to it and enhancements to it. Not that I know of.

Speaker 4: Okay. That’s it for now.

Chris Gordon: Let’s just touch on a little bit of reporting and analysis to wrap up here. After all, you have these transactions coming out of your ERP system and you need to be able to report on them. Lease Management has that ability in terms of both online inquiries as well as reports. Here is a few that are pretty helpful. We have our lease invoice inquiry, our LM90 which we just saw. We have our LM94, which does more of a lease analysis period over period. You can also look into your executory costs. Those additional related costs that we’ve attached to our leases. We can report on those. The big one on the reports side I want to touch on is the lease projections, LM430. We’re going to take a walk through what all these look like over the next couple minutes.

LM90, we won’t spend too much time on because we just saw it. LM94 is very similar. The only difference here is you have the option to switch up your period range so you can kind of be flexible with what period you’re looking at. It’s essentially giving you the same amount of data, but giving you a beginning balance, period balance and then an ending balance. If you click off here, the executory costs only, you’ll see you have the ability to look at just the executory costs and houses for that lease. If there is that CAM or insurance you can go back and review that.

LM430. This is a pretty powerful report. It’s your lease projections. What we have here, again, is just the one company, one hospital. Sorry, company one, lease number one. We have this … I think this was a five year lease. Maybe a little bit after. It’s breaking it down by year and showing us on this first row payments for the first year, second year, third year, fourth, fifth and any after. This was a capital lease, so it’s also calculating what those interest expenses are going to be over the courses of those years. This executory costs. I didn’t have any on this lease, but if you did you would have them summed together. If you had multiple executory costs, they’d all lump into that one line. The very bottom, Lawson has calculated our net present value of all of our lease payments. Same general format. First year all the way to the end, and has broken down those numbers by payment, interest, and executory costs.

This is just at the end. It’s a little summary of that report. Summarized your capital leases. I didn’t have any operating leases under this company. It breaks that out, gives you a total amount for all your leases and then will calculate your present value of the minimum lease payments.

New lease requirements. This is the last thing we want to touch on. Basically, starting in 2019, all of your leases must go on the balance sheet. FASB and IFRS. IFRS is the international regulating authority and FASB is the US regulating authority. They’ve set new standards that impact both the lessors and the lessee. Essentially, your leases must go on balance sheet. The operating leases, they had that really only impacting your income statement. Now, are going to be impacting your balance sheet. That’s the big takeaway from those two, or really the one new accounting rule that these authorities have put into place beginning 2019. You can actually adopt that as early as you want. If you wanted to throw your operating leases on your balance sheet now, you could. There’s a lack of consistency though between the way that the IFRS and the US GAP accounts for things. If you are a multinational corporation, you might have additional lease … IFRS, everything is a financing lease. Whereas, GAP, it’s a little different so you might have to do a little bit more work between if you do have operations over seas to account for your operating leases.

That also kind of brings up the question, if all these leases are now on your balance sheet, how does that affect your capital budget? Maybe all those operating leases fell under your operating expense budget before, but now you might have to take into account that they’re going to be hitting your capital expense budget. There’s a link at the bottom here you can click on or go to to get more information if you want, around these new lease accounting regulations, but that’s all I have for you guys today.

Just a quick summary of what we’ve talked about. Lease Management is a powerful tool. A lot of the processes that you might be doing outside of Lawson you can now incorporate into Lawson and take advantage of the streamlined nature of Lease Management into AP. It benefits organizations with a lot of leases. 5, 10, 15 leases – it might not be the tool for you, but if your organization is managing hundreds or thousands of leases this is something that you want to at least consider. Last but not least, proper planning and testing is critical for successful implementation of this tool.

We’ve got about 5 or 10 minutes for questions, but that’s all I have for you guys.

Speaker 4: We do have a few questions here. If you’ve entered executory expenses via the recurring entry and the payment amounts change later, must you manually adjust each transaction already pushed over to the schedule?

Chris Gordon: Repeat.

Speaker 4: Okay, well I’ve been looking at the question for 10 minutes so I might as well handle it here.

This is common, right? Think CAM on a building lease, office lease, it might not be calculated what the new year’s CAM is going to be until a few months into the year. At least in my experience, you normally pay the base amount that you were paying in the past year, but then there’s going to be a catch up. Normally what we’ve advised our customers to do is to make that one-time payment as the catch up and then adjust the schedule going forward. If you adjust it on the recurring page, it will adjust all the go forward monthly payments. You do not need to manually adjust every monthly payment. Okay, I think the answer is no.

Have you been in contact with Lawson about when they will make updates to LM for the new lease standards?

Chris Gordon: No. I was actually about to do that yesterday. It is a good question. How is Lawson going to add that functionality to when you define your leases? I don’t have an answer for you now, but we can follow up with you. I’ll open a ticket with Infor and just kind of get some feedback from them.

Speaker 4: Okay. Rich, I’ll get to your question in a second. Can you just spell out what ASU is. I’m not sure if I’m just not familiar. I’ll go onto the next question.

What type of notification is given when an option is about to expire?

Chris Gordon: An option as in like, you should renew versus renew on this date?

Speaker 4: Exactly. Options might be typical again in office leases, where you might have a five year lease but three, two year options. What you’d normally do when you set up the lease under those date codes, you would put in some sort of date that you have 60 days before the expiration in order to exercise your option at a predefined amount. You can then just run your reports as part of your normal monthly process and it’ll show you all of these date codes that are triggering whatever that trigger might be. Usually an expiration or some sort of notification to work those leases.

Chris Gordon: Unfortunately, it’s not really an alert to you. You’ve got to run the report, make it part of your process, review that report to see when those dates are coming up.

Exactly, you could build something around that like a smart note or a work flow to go out and look periodically at those dates and push an email or a smart note to you.

Speaker 4: Okay, so I guess this is similar to the other question. I’m sorry, I should’ve understood. ASU is the new accounting standards.

What modifications do you expect to be made to the module for the new ASU?

I don’t think you really have that answer, but we’re going to stay close to it.

Chris Gordon: Well, if everything’s got to go on the balance sheet then I mean, there’s got to be somewhere on that when you define your lease, to put it to the right balance sheet. Other than that, I’m not totally sure what they have in mind to augment the module to take into account for those new standards.

Speaker 4: We’ll keep this distribution list when we do get some more information on that, because we have been curious as well but we have not talked to the product manager yet. No further questions at this point. We’ll hand it back to you.

Keith: We’ll start wrapping it up. I want to give a shout out to Greg Pollard, the voice behind the camera. Actually has worked with the Lawson Lease Management. Also negotiated all of our PI’s office leases, so he’s very familiar with some of those nuances. Of course, Chris Gordon. Great job. If you like Chris Gordon’s presentation, I will point out that he is presenting again tomorrow at 1:00 PM on Smart Office. It is a presentation geared towards power users. So all of you in finance departments, I would assume. It’s geared toward you, see what you can do with Smart Office.

Chris Gordon: Yeah, we’re going to be building a work space kind of designated or designed for an AP super user. All the cool little things you can do in Smart Office, we’re going to show you tomorrow.

Keith: There’s a very large registration form. Brought a lot of interest. I will also add that when we’re trying to get Chris to do more, what fuels him is compliments. So, if you like it, definitely give that feedback. We’ll cycle it back to him. He’s been really good at coming up with new and fresh presentations. If there’s any information you’re looking for, again, loop that feedback in the survey, let Bill Getty know and we’ll see as time allows what else we can do. With that, we’ll wrap it up. Thank you very much Chris.

Chris Gordon: Thank you.

Want More Content?

Sign up and get access to all our new Knowledge Base content, including new and upcoming Webinars, Virtual User Groups, Product Demos, White Papers, & Case Studies.

Entire Knowledge Base

All Products, Solutions, & Professional Services

Contact Us to Get Started

Don’t Just Take Our Word for it!

See What Our Clients Have to Say

Denver Health

“RPI brought in senior people that our folks related to and were able to work with easily. Their folks have been approachable, they listen to us, and they have been responsive to our questions – and when we see things we want to do a little differently, they have listened and figured out how to make it happen. “

Keith Thompson

Director of ERP Applications

Atlanta Public Schools

“Prior to RPI, we were really struggling with our HR technology. They brought in expertise to provide solutions to business problems, thought leadership for our long term strategic planning, and they help us make sure we are implementing new initiatives in an order that doesn’t create problems in the future. RPI has been a God-send. “

Skye Duckett

Chief Human Resources Officer

Nuvance Health

“We knew our Accounts Payable processes were unsustainable for our planned growth and RPI Consultants offered a blueprint for automating our most time-intensive workflow – invoice processing.”

Miles McIvor

Accounting Systems Manager

San Diego State University

“Our favorite outcome of the solution is the automation, which enables us to provide better service to our customers. Also, our consultant, Michael Madsen, was knowledgeable, easy to work with, patient, dependable and flexible with his schedule.”

Catherine Love

Associate Human Resources Director

Bon Secours Health System

“RPI has more than just knowledge, their consultants are personable leaders who will drive more efficient solutions. They challenged us to think outside the box and to believe that we could design a best-practice solution with minimal ongoing costs.”

Joel Stafford

Director of Accounts Payable

Lippert Components

“We understood we required a robust, customized solution. RPI not only had the product expertise, they listened to our needs to make sure the project was a success.”

Chris Tozier

Director of Information Technology

Bassett Medical Center

“Overall the project went really well, I’m very pleased with the outcome. I don’t think having any other consulting team on the project would have been able to provide us as much knowledge as RPI has been able to. “

Sue Pokorny

Manager of HRIS & Compensation

MD National Capital Park & Planning Commission

“Working with Anne Bwogi [RPI Project Manager] is fun. She keeps us grounded and makes sure we are thoroughly engaged. We have a name for her – the Annetrack. The Annetrack is on schedule so you better get on board.”

Derek Morgan

ERP Business Analyst

Aspirus

“Our relationship with RPI is great, they are like an extension of the Aspirus team. When we have a question, we reach out to them and get answers right away. If we have a big project, we bounce it off them immediately to get their ideas and ask for their expertise.”

Jen Underwood

Director of Supply Chain Informatics and Systems

Our People are the Difference

And Our Culture is Our Greatest Asset

A lot of people say it, we really mean it. We recruit good people. People who are great at what they do and fun to work with. We look for diverse strengths and abilities, a passion for excellent client service, and an entrepreneurial drive to get the job done.

We also practice what we preach and use the industry’s leading software to help manage our projects, engage with our client project teams, and enable our team to stay connected and collaborate. This open, team-based approach gives each customer and project the cumulative value of our entire team’s knowledge and experience.

The RPI Consultants Blog

News, Announcements, Celebrations, & Upcoming Events

News & Announcements

Choosing the Right AP Invoice Automation Solution for 2025

Chris Arey2024-11-13T14:33:50+00:00November 12th, 2024|Blog|

Why Your ERP System Needs a Post-Implementation Audit

Chris Arey2024-11-01T14:02:10+00:00October 29th, 2024|Blog|

3 Key Insights from the 2024 Infor Velocity Summit

Chris Arey2024-10-21T18:48:08+00:00October 15th, 2024|Blog|

Healthcare Supply Chain Insights from AHRMM 2024

Chris Arey2024-10-06T16:42:23+00:00October 1st, 2024|Blog|

ERP Security: Issues to Consider & Best Practices to Follow

Chris Arey2024-09-21T10:00:15+00:00September 17th, 2024|Blog|

High Fives & Go Lives

AP Health Check at Jeffries Creates Path for Increased Efficiency, Visibility

Michael Hopkins2024-11-15T16:48:19+00:00November 30th, 2020|Blog, Brainware, High Fives & Go-Lives, Perceptive Content / ImageNow|

Customer Voices: Derek Morgan, MNCPPC

RPI Consultants2020-12-16T17:50:32+00:00August 14th, 2020|Blog, High Fives & Go-Lives, Infor CloudSuite & Lawson|

Voice of the Community: Jen Underwood, Aspirus

RPI Consultants2024-02-26T06:04:23+00:00March 14th, 2020|Blog, High Fives & Go-Lives, Infor CloudSuite & Lawson|

Voice of the Community: Keith, Denver Health

RPI Consultants2024-11-18T18:38:18+00:00March 14th, 2020|Blog, High Fives & Go-Lives, Infor CloudSuite & Lawson|

AP Automation Case Study at Nuvance Health

Michael Hopkins2024-11-15T15:52:56+00:00March 4th, 2020|Blog, High Fives & Go-Lives, Infor CloudSuite & Lawson, Knowledge Base, Kofax Intelligent Automation, Other Products & Solutions, Perceptive Content / ImageNow|

Upcoming Events

RPI Client Reception at CommunityLIVE 2019

RPI Consultants2024-02-26T06:09:32+00:00June 20th, 2019|Blog, Virtual Events, User Groups, & Conferences|

Free Two-Day Kofax RPA Workshop (Limited Availability)

RPI Consultants2024-02-26T13:24:38+00:00June 13th, 2019|Blog, Virtual Events, User Groups, & Conferences|

POSTPONED: Power Your Logistics Processes with a Digital Workforce with Kofax

RPI Consultants2024-02-26T13:29:29+00:00May 29th, 2019|Blog, Virtual Events, User Groups, & Conferences|

You’re Invited: Customer Appreciation Happy Hour

RPI Consultants2024-02-26T06:27:45+00:00March 14th, 2019|Blog, Virtual Events, User Groups, & Conferences|

RPI Consultants Sponsors 2019 Michigan Manufacturing Operations Conference

RPI Consultants2024-02-26T13:53:21+00:00January 30th, 2019|Blog, Virtual Events, User Groups, & Conferences|