Procure to Pay Optimization: Everything You Need to Know

By: Dan Farruggio April 30, 2024

The process of requisitioning, purchasing, receiving, paying for, and accounting for goods and services received by your organization is known as procure to pay, or P2P. Traditionally, P2P has been a laborious manual process.

Now, however, organizations are recognizing the importance of optimizing, and automating P2P processes.

Here’s the proof—according to a recent Research and Markets report, the procure to pay outsourcing market is forecasted to reach $10.13 billion by 2028. That’s up from $6.62 billion in 2022.

Implementing an automated solution can help organizations optimize their P2P process, as well as reduce risk, improve relationships with suppliers, and of course, conserve resources. In fact, another report finds that companies can save 20% on labor costs by using P2P automation.

In this post, we’ll take a closer look at the P2P lifecycle, and some steps organizations can take to optimize their procure to pay process. We’ll also identify benefits that can result from adopting an automated solution with help from an experienced implementation partner.

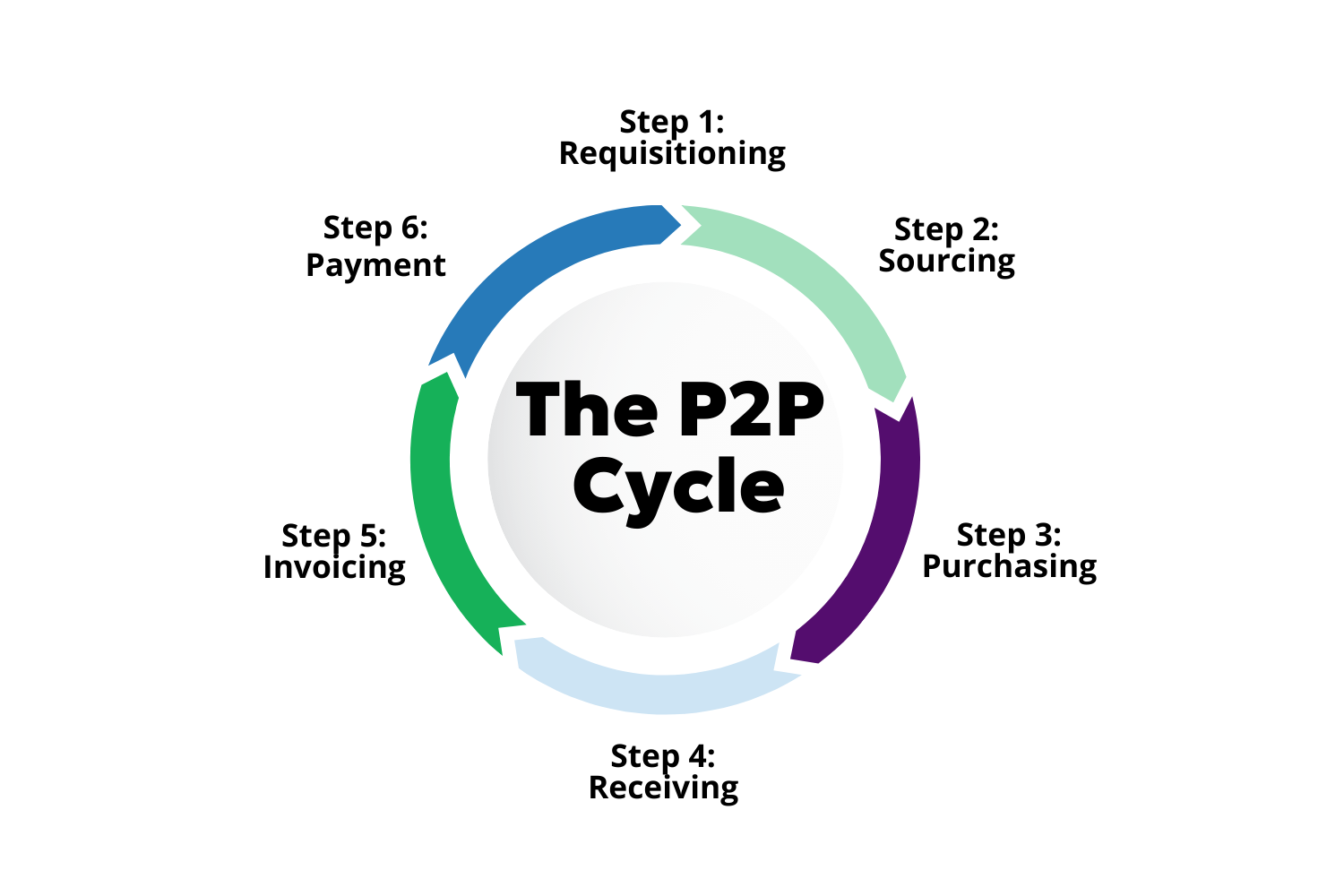

The procure-to-pay lifecycle

Before we discuss how automation can streamline P2P for your business, let’s take a look at the steps involved in the procure-to-pay lifecycle.

Step 1: Requisitioning. Once a company identifies a need for goods or services, they create a formal purchase requisition. These can be used for standard purchases, as well as consignments and subcontracts—virtually anything that the organization needs to procure.

Step 2: Sourcing. This is where the company screens potential suppliers. Requests for quotations (RFQs) and verification checks need to be completed, and vendors should be evaluated against desired profiles.

Step 3: Purchasing. After the need is evaluated, the budget verified, the requisition order completed, and the vendor identified, the company sends approved purchase orders to the selected supplier(s).

Step 4: Receiving. Once the goods are delivered, the purchasing company inspects the items to make sure they’re in compliance with the contract and approves (or rejects) the goods receipt.

Step 5: Invoicing. Next, the company performs a three-way match between the purchase order, the supplier’s invoice, and the goods receipt. If there aren’t any discrepancies, the invoice is sent to the finance team for payment.

Step 6: Payment. The payment process includes creating an invoice and arranging to pay the vendor. When receiving an approved invoice, the finance team will process payments according to the contract terms and record the transaction.

Procure to Pay Optimization Best Practices

Streamlining P2P can help ensure regulatory compliance between your business and your vendors, as well as strengthen control around contract management and accounts payable. It’s the best way to gain context over every dollar your organization spends.

Some best practices for optimizing the procure to pay process include taking the following actions:

Focus on analytics and metrics: Analyze your historical data to find ways to make better decisions and identify opportunities to save. Simply said, let your data do the talking. From there, you can negotiate better pricing, consolidate purchases, and reduce or eliminate maverick spend.

Your company can also track data from key performance indicators, such as cycle time, on-time payments to vendors, and cost savings from negotiation.

Use e-procurement systems: Your organization can boost the efficiency of your procure to pay cycle with an e-procurement system. For example, your employees can easily search for approved products and services on intuitive online catalogs from vetted vendors.

They can also improve cycle times by automating requisition and approval workflows; foster more effective partnerships with vendors through supplier portals; and streamline the flow of information to financial systems with integration.

Collaborate with suppliers: Relationships are at the heart of every business transaction. Your organization can work more effectively with its vendors by creating a relationship management strategy that aligns with your procurement goals.

In your strategy, you should include technology solutions, like Yoga Flexible Software, you can use to enable real-time data sharing. It’s also important to keep communications open with vendors, in regularly scheduled business reviews, and to encourage your suppliers to make innovations of their own.

Benefits of Procure to Pay Automation

Your company can boost its efficiency in procurement management by automating its P2P process. Doing so will help your company solve business issues and realize significant savings.

For example, you’ll see reduced costs as the result of efficiency and an improved negotiation standpoint. You’ll also mitigate the costs associated with compliance risks and fraud prevention. And of course, automated P2P leads to better relationships, and increased transparency, with your suppliers.

Here are just a few of the ways how:

Easier requisitioning: With an automated P2P solution, your company can more easily establish and follow clear procurement policies, handle standardized requests, and identify opportunities to save money.

For example, an automated P2P solution can validate purchase requests by cross-checking data and reject the requests that have missing or inconsistent information.

More visibility and control: An automated solution will give you real-time visibility into the status of POs, budget use, as well as upcoming vendor payments. You’ll also be able to automatically flag costly process delays or violations of policy for timely intervention.

Supplier selection and sourcing: An automated solution will help you gather and screen requests for quotations; evaluate suppliers based on quality of goods, performance, and pricing; and use e-sourcing to make your bidding processes more efficient.

Your organization can also create and maintain a database of suppliers, so the best vendors can be identified using a list of predefined rules, all with the click of a button.

Seamless collaboration: Suppliers’ queries about invoices and payments can be routed to relevant stakeholders automatically. And spending requests from your business units can be matched with the right vendors almost immediately.

Purchase order management: With automation, companies can streamline PO processing; for example, you have the option to standardize formats and speed up approval workflows. You can also maintain optimal stock levels by integrating PO processing with your inventory management system.

Everything around the PO process can be automated and simplified, from creating and dispatching POs to generating contracts and notifying stakeholders.

Faster transactions: Automatic coding of expenses, verification of line items, and detection of duplicate invoices speeds up transactions. This in turn results in faster processing, and faster payments to vendors.

Better supplier management: Automation puts metrics at your fingertips; seeing vendors’ on-time deliveries, accuracy, responsiveness, and pricing compliance will enable you to shift business to the most reliable suppliers.

Stronger cost control: Integrated supplier catalogs offer more visibility into what’s purchased from which suppliers. As a result, your procurement team can easily find ways to make sourcing more efficient and inform you of discounts on purchase volumes.

More accurate receipt of goods: Your automated P2P system should help your team make the receiving process more accurate, with barcode scanning and radio frequency identification technology, as well as mobile applications that enable on-the-go receiving.

It should also be able to reconcile POs and received goods on a regular basis to save your team members time.

Invoice processing: By automating the invoice capture and validation processes, your company can simplify three-way matching of the PO, receipt, and invoice to prevent discrepancies. In this way, you’ll be sure to pay only for the goods/services you receive.

Plus, electronic invoicing can reduce the time and effort associated with paper-based invoicing processes.

Higher productivity: Automation enables employees to focus on value-added activities, such as analyzing spending patterns and cost structures, by sparing them the need to manually process POs, correspond with vendors about status, and maintain records.

Handling of vendor credit hold: A “vendor credit hold” refers to when a supplier restricts a purchaser’s ability to buy goods or services on credit. This suspension of credit is imposed on a customer who’s exceeded their credit limit or failed to make payments on time. It can also happen as a result of disputed invoices.

A credit hold can impact your organization’s ability to conduct business in a timely manner. That’s why an automated P2P system is so vital: it helps ensure timely payments, effective communication with suppliers, and quick resolution of disputes.

Payment automation: The right system will enable your organization to implement, and reap the time-saving benefits of, electronic payment methods, including automated clearing house (ACH) or virtual credit cards.

You can also prevent unauthorized payments by using automated payment approval workflows, and take advantage of seamless reconciliation by integrating your payment system with your accounting software.

Get Expert Help with P2P Optimization

Getting your P2P processes off paper, and into the cloud, will help your organization save valuable time and money.

That’s why forward-thinking organizations are leveraging technology such as Infor Finance & Supply Chain Management and adopting best practices from proven technology partners like RPI Consultants.

To find out more about how P2P optimization can help you create smoother operations, build stronger relationships with suppliers, address pain points like vendor credit hold, and much more, register for our upcoming webinar, Optimizing P2P: A Roadmap to Procure-to-Pay Success, below.

Follow us online for faster access to announcements, knowledge base updates, and upcoming events!