All Things Accounts Payable Automation

By maximizing or combining enterprise software and technology investments, Accounts Payable and Finance departments can effectively eliminate manual data entry and processing for invoices – significantly reducing costs and delays to get vendors paid faster. Join Senior Solutions Architect Alex Lindsey and Consultant Sean LaBonte to learn more about which products you can use to automation your invoice processing workflows.

Transcript

Alex Lindsey:

Hello everyone, and welcome to another Webinar Wednesday with RPI Consultants. Today we’re going to be talking about accounts payable automation for invoice processing and how it could potentially help your solution. And really this is very informational, we’re trying to dig a little bit deeper into what it is. We talk about it quite a bit here at RPI with a lot of our materials and our webinars, but this really digs into how we can automate certain key aspects or all of your invoice processing.

A few housekeeping items to get started. First and foremost, this presentation will be recorded. We’ll be posting this online as well for you to view at a later time or to share if you’d like. The PowerPoint deck will also be distributed. If you have any ideas for future webinars we’d be happy to hear those, and we’ll have an opportunity for questions at the very end, so if you have those go ahead and put those in the GoToWebinar questions box that’s right there so we can get those queued up.

So first and foremost, we do have a few other upcoming webinars. Next month we are only having one due to the holiday week, and we’re going to be talking about what’s new in Perceptive Content / ImageNow, whatever you guys would like to call it, 7.3. And then the month following we’ll be talking all about robots, robotic process automation, RPA, one for accounts payable and then some tips and tricks with our very own Geoff Lilienfeld.

Sean LaBonte:

Right. First off, I’d like to introduce Alex Lindsey. He’s a senior solutions architect with RPI, has many years’ experience designing, implementing, and supporting ECM and advanced data capture solutions, specializes in accounts payable integration, some non-standard solution designs, and OCR. He’s also a master whiskey distiller, seriously, it’s delicious, he’s a novice ax thrower, I don’t know how you’re still a novice after all these years, but…and also, he’s a nerdy dad, loves BioShock.

Alex Lindsey:

He’s a consultant. He has over two years’ experience designing, implementing, and supporting solutions from Hyland, Infor, and Kofax. He specializes in project management, that was actually how he came up through the ranks. He works in accounts payable automation solutions as well, and he is a CAPA certified, certified accounts payable associate. And he’s Kansas City’s second most eligible bachelor.

Sean LaBonte:

Yeah, I’m coming for you Travis Kelce.

Alex Lindsey:

So, going over the agenda today, we’re going to talk a little bit about RPI Consultants, who we are, what we do, and then we’ll jump into the overview of just how we would automate accounts payable processing. So that goes through invoice capture, the intelligent data capture, which we’ll explain in a lot more detail, workflow exception handling, approvals, how we integrate and get that payment information into your accounting system, as well as the reporting analytics that happen on the backend.

We’ll also have an opportunity to discuss some additional automation opportunities, so you may say, we have something in place now, but maybe we want to automate some other pieces, and then we’ll open it up for questions.

Sean LaBonte:

Right. So first a little bit about us, RPI Consultants. So, we’re a professional services provider and software reseller for the industry’s leading enterprise content management and business process automation technologies, including Infor Lawson, Kofax, and Hyland Software. Now is a pretty exciting time to be working for RPI, we have over 100 full-time consultants and project managers and architects across multiple locations in the US, on the East Coast and Midwest. We offer services as far as technical strategy, upgrades, migrations, system design, managed services, and we have project management and change management to help oversee all these tasks all the way through to delivery.

Alex Lindsey:

So, jumping right into accounts payable automation, what is it, how can it help you. Accounts payable automation, and we say this, again, like I mentioned earlier, we say this term all the time, this is how you can automate your invoice processing solutions. So, we’ll go over a number of different things from each key area that we can automate a lot of these processes within your accounts payable team, show you a lot of different ways that you could automate those, discuss different options. We’ll touch on maybe some of the softwares, but that’s not really the point of this presentation. The point of the presentation is to make you understand or to help you understand how you can really reduce the time it takes to pay your vendor invoices.

So why would you adopt something like an AP automation solution with the software you have or the software that you are currently exploring? First and foremost, it reduces costs. You will be able to process invoices faster, it sometimes requires less overhead, you can really take advantage of those early payment discounts and rebates and really just avoid those late payment fees.

It also reduces errors. If your users are currently just manually entering in the invoice data into an SAP or an ERP or something like that it takes a lot of time. There’s a lot that goes with it, if you have paper invoices versus emailed, if they’re PO versus Non-PO, and that ultimately can lead to a lot of errors and a lot of delays, which sometimes is no fault of their own, it’s just the nature of the beast.

Sean LaBonte:

Right. So, we’ve got the why down, let’s start looking into the first step of getting documents actually into your system. There’s a handful of different options here and one of them might be physical invoices, so you’re receiving invoices via mail, you’re having your clerks open them in the mail room and sorting them out, ready for them to be scanned into your system. Once you scan in these invoices you’re delivering them to a network drive typically and you need to have them imported, this can be either a manual task or it can be another point of automation, which we’re going to cover here today.

Alex Lindsey:

Mm-hmm (affirmative).

Sean LaBonte:

There’s also an option for emailing invoices in, this can be sending invoices directly to just one dedicated inbox or several depending on the type of invoice that you’re going to be receiving, and then trying to get them into your system, which, again, can be another point of automation. You can also be receiving faxed invoices, if you are, please stop, but it’s…faxed invoices, they’re going to be coming into a dedicated line, they’re going to be captured electronically or imported, sometimes I’ve even seen people start printing them out and then scanning them in too, going to the network share.

There’s also EDI, so this is the Electronic Data Interchange. So, this is going to require a dedicated setup, you might have something set up with that specific, like GHX, and try to import those eight, 10 files into your system.

Alex Lindsey:

So, one other thing to talk about with the invoice capture too, a lot of the softwares that we work with already have ways to capture documents through email, what we really like to recommend to clients is that you get to an automated process. Start training your vendors to send just invoice documents to one particular inbox so when you deploy a solution like this you can really kind of streamline the flow, have one entry point for just invoice documents as opposed to AP correspondences, vendor documents, things like that. This is what we highly encourage our clients to do is to kind of move in that space so you can really set yourself up for success.

Sean LaBonte:

Mm-hmm (affirmative).

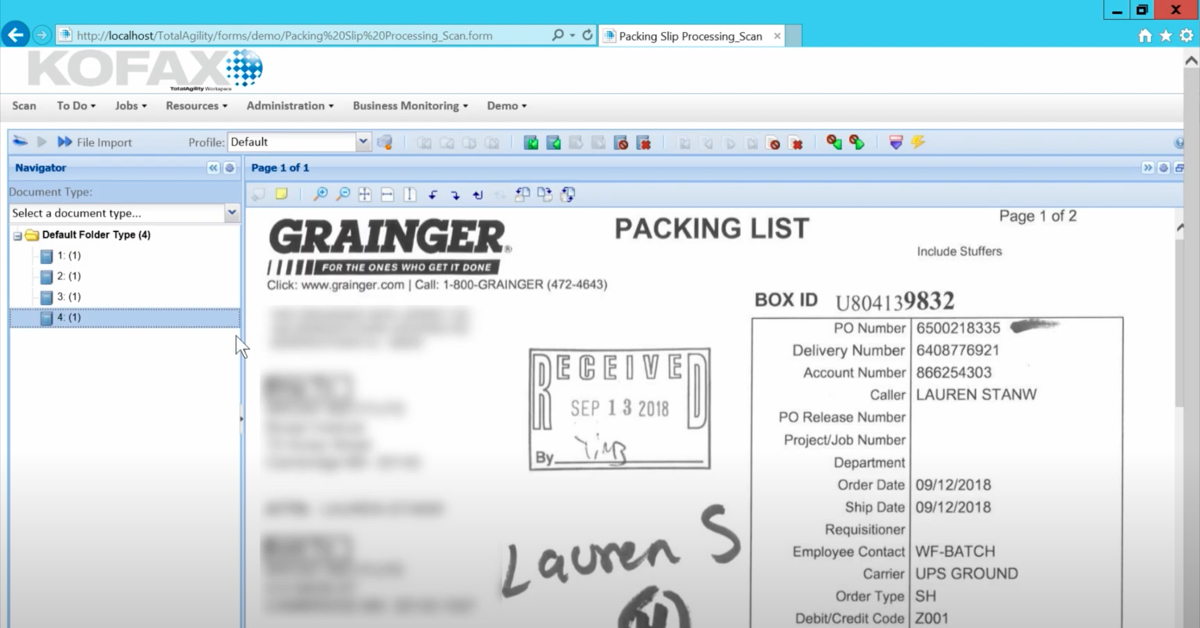

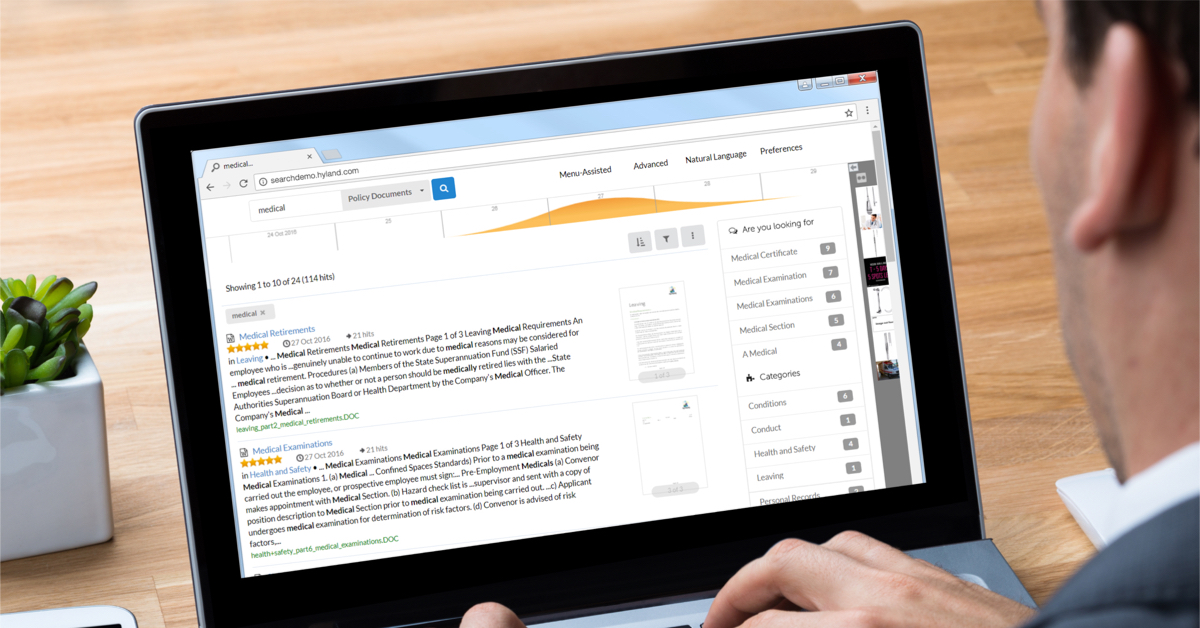

Right, so speaking of capture, you need to start…once you have the documents into your system you need to start extracting values and data off of those documents. We work through a bunch of different products, primarily looking at Kofax KTA, ReadSoft Online, and Brainware by Hyland to start reading and sorting and understanding what is on these documents. So let’s talk about how we’re going to replace manual data entry with some key points of automation, just at a high level.

First off, when you start receiving documents, invoices, into your system, previously in a manual task you might have a clerk sorting out these documents into different types of invoices, that’s really what we’re pointing to right here, invoice classification. You can actually have a system start to do this for you so you can relieve that duty from one of your employees or clerks.

Once you start getting these invoices in, you know what type it is, you can start indexing values off of it, start removing some of the header-level data from the invoice itself, which is going to start opening up more opportunities for you to start putting in like logic such as duplicate invoice checking, you can start matching with line items, and invoice exception flagging. So, again, this kind of goes back to the duplicate invoice, for example, you can start putting in logic to automate three-point, five-point duplicate checks, for instance.

Alex Lindsey:

Mm-hmm (affirmative).

And there are a couple of options for these type of technologies, so OCR technology, sorry, optical character recognition, where, like Sean says, these softwares, they just read through these invoice documents and try to pull those values. With that, and Sean did a great job mentioning this, it identifies…so with these technologies it’s built in typically, so whether it’s a Kofax TotalAgility, ReadSoft Online, also offered by Kofax, or if it’s Brainware by Hyland, these technologies have been trained automatically. It’s built within their programming to identify if it’s a Non-PO invoice, a purchase order invoice, or a credit memo. So, there’s no longer that need to kind of channel your work in different ways so you can approach your manual entry into that screen, really if it’s an invoice or credit memo just email it in, send it into one of these OCR technologies that can just read through it and make that determination automatically.

It also does data extraction and validation, so these technologies are built, again, to pull the data. So, if you think about an ATM where you’re able to slide in a check and have that automatically deposited, and it can read that information, it’s similar to that, but a lot more complex. So, it’s going to automatically find your invoice number, your invoice date, all the header information on an invoice, and for PO invoices in particular, this is great. These technologies all have line pairing capabilities, meaning that it will pull the purchase order lines from the actual invoice and are able to extract that successfully to display for you guys.

But with that, and this is where the key value and the true power of using intelligent data capture comes into play, is that it verifies this information against your accounting system. So if you have SAP or Lawson or Dynamics AX or any other accounting system really, when it pulls vendor information it’s going to look for an address, it’s going to bounce that address that it pulled off, off of your accounting system and try to say, this is this vendor, I know that it’s at 123 Johnson Street, so this must be ACME Corp. And it can make a logical and basically confidence-driven determination that that is the true vendor. Again, this is information that your user no longer has to do because the system is doing it for you, so that it is minimal user impact.

One thing to call out though with these technologies, there’s different rules you can obviously set up, but if you want to stop every one you can, so a user can look at it. We don’t encourage that necessarily, but if something does stop it’s typically because one, it couldn’t read or find the data it was trying to find, two, it failed a validation check. So these technologies include a lot of things like duplicate check, if an invoice falls within or without a date range, if we need to flag it for some reason, these technologies are all built to basically do these things, and it’s very powerful because it can compare that versus your accounting system.

It also, for a bit of it, it limits the data entry mistakes as well, so users, you can limit what users can and can’t put in there, you can format that information to match your accounting system as well, and that way they can basically process.

So their job, instead of keying in an entire invoice at this point, their job is…essentially their role is reduced to, hey, making good decisions and logical decisions about what is on this invoice and making sure it’s correct. So, they’re filling out one, maybe two fields for an invoice as opposed to the entire invoice record.

Sean LaBonte:

Mm-hmm (affirmative).

Alex Lindsey:

And, again, after this one thing to call out as we’re moving down the line, so we’ve captured the invoice document, we sent it to an intelligent data capture technology, after that it can do a number of different things. It can go into a workflow, so that can be an ECM like a Perceptive Software or OnBase by Hyland, it can go into an ERP-specific workflow like Infor’s APIA, or it can just go directly into your ERP. If you are comfortable with the data that’s extracted and you want to get that into the system to be posted or go through its own workflow that’s totally fine.

Sean LaBonte:

Right, and kind of speaking on that too, Alex, you started talking about some of the pain points that you try to actually alleviate by these automated processes, I want to kind of cover those first. I’m sure some of you watching are all too familiar with this of course, but some of these manual processing pain points that we try to identify when we go into an engagement to help a lot of our clients would be such as physically passing documents back and forth. You just have a whirlwind of documents that you have to keep track of, that’s difficult to do in a physical, manual process. Including continual email streams, when you’re going to ask repeated questions about it because you don’t know where an invoice is this is just adding some tedious work that doesn’t need to be there anymore.

For instance, you could have a loss of documents as well. This is something just as simple as just being human and accidentally knocking an invoice down behind a desk, don’t know where it is.

Alex Lindsey: Mm-hmm (affirmative). Yep.

Sean LaBonte:

You could also be spinning your wheels working on duplicates because in a manual process you don’t really have any logic there to tell you that there is a duplicate invoice in the system at this point. You could lose line of sight on invoices, so, for instance, I try to equate this to kind of a black box. You can hand this off to a processor, but once you hand it off if it’s a completely manual process you don’t have oversight anymore to really be able to tell where that invoice is, maybe customer service needs to get ahold of you for where that invoice is, it’s just-

Alex Lindsey:

It’s there-

Sean LaBonte:

…you really don’t know.

Alex Lindsey:

It’s there and then it’s gone.

Sean LaBonte:

Yeah. Yup, and because of that you don’t have accurate reporting or analytics, and that is something that can be a huge return on investment, and being able to actually gauge that as well. When you have a manual process you just don’t have an accurate level there.

And also of course any manual invoice data entry, we want to try to alleviate that as much as possible to free up our AP processor, so the speed [inaudible 00:14:02] information or line matching, for instance.

Alex Lindsey:

Right, so how do we handle that? How do we automate this process as much as possible? So, this is usually the bigger part of an implementation or an AP automation solution that I deal with clients with all the time. This is where we have decisions, this is where we can customize an accounts payable solution to your specific user group, to your specific policies that you have in place, maybe it’s an opportunity to change some policies as well.

But ultimately it comes down to these key values here, you get the data validation within a workflow. So, after you get that extracted data, you have the document with it, you can go into a workflow system where it will…first and foremost, we’re going to validate that information again before it goes to anyone else. We just want to make sure that we’re checking as much as possible that the data is correct, that the required fields that your accounting system are going to require are there, and then making basically another duplicate check as well to make sure that nothing coming through is going to get paid again.

With that, a lot of times with a workflow and exception handling process there is an electronic form as well so you can see. And really the reason that we do this quite a bit with a form is that there’s going to be line details that are going to have to be dealt with, so whether that’s GL coding, so this needs to go to someone in a different department for GL coding, or maybe it just goes to a shared services center, or one single person just knows what all the coding is. These are all determinations that are made during the design session, and these can be built out within pretty much any workflow that you guys would like to built out.

Along with that, auto line matching, and this is a huge benefit to a lot of customers as well. If you are heavy, if you’re, for instance, in the manufacturing industry and you are very heavy with just purchase order invoices the auto line matching is a great, great tool to use, and it’s included with a lot of these workflows. Ultimately what that means is we’ve extracted the purchase order line details within the intelligent capture software, we’ve taken those values, we’ve validated that they line up for the most part within the OCR technology, and then we’ve moved it into a workflow where another script or sub-process will run and say, yes, that’s good to go, let’s go ahead and just post this invoice, let’s not wait or stop it for any reason or have someone look at it. If it’s good to go then let’s get it paid as quickly as possible.

Now within this you can also set up rules for purchase order types as well, so if it is a service PO you can send it to an approval process if you want, if it’s materials it could just move on. However you guys want to handle that, you could do it. The main point being, you’re creating a single-system solution, with that you are streamlining your invoice documents through the workflow, through the GL coding, through the line matching, but within that you’re able to do a lot of other things, you can now have the opportunity to do buyer communication. Where right now your accounts payable team may need an adjustment on a purchase order before they can post an invoice, that means they have to either send the invoice to them or they have to email them, and we’ve worked with a lot of clients before where there’s just maybe not great communication between those departments.

With a single-system solution you can set up a sub-process to automatically flag a certain PO or automatically check if there is enough money on that PO, and that could be sent directly to the buyer with a message saying, hey, you need to increase the amount on this purchase order before we can pay this. All that exception handling should any errors happen, missing fields, missing vendor, vendor not active, things like that, can be handled within there as well. And depending on who it needs to go to or who you want responsible for handling those, that can be defined as well.

And with that I mentioned forms, but those forms, again, similar to the intelligent capture are going to be directly integrated with your accounting system, that means that there will be lookups. So if I’ve got my electronic form and I need to change the vendor or the remit-to, most likely, I can do a lookup directly to your accounting data, pull that onto the form, validate that form, and move it on.

So the next piece, we talked about GL entry, GL coding, things like that, the next piece, and this sometimes becomes a major pain point for a lot of our clients…and I’ve worked with a lot of clients when it comes to invoice approvals. It’s always surprising to me the different things that different companies have, the hierarchies, the rules in place, the types, where it needs to go. It can get very complicated. So imagine that, so imagine your existing approval process right now and imagine it being automated in a way that can be pushed forward automatically.

Right now, and we have this icon here because it’s a constant stream of emails, so if you’re accounts payable associate says, this needs to go to this person, and I’ve seen this before where one person is responsible for getting it to approvals based on how much it is, so they send it to one person. That person sends them an email back saying, approved, and they send it to the next person, and that’s the audit trail that happens through email. We all get a lot of emails every day, so things tend to get lost, and so you get a lot of delays when it comes to that.

It’s also kind of an audit risk when you think about it. Like, there’s no good way to track some of this information, there’s really no standardized approach to how you do it. Some person may email someone that needs to approve an invoice and say, hey, please approve this, or, hey, please approve this, but also can you look at this other thing? It’s just not, it’s not a very standardized approach, it’s not very clear sometimes, and things can kind of get lost in the ether.

You can also lose a lot of invoices this way. If you’re even just passing them around or you’re emailing them it’s easy to lose track of those type of things. Ultimately, a non-standard or non-structured approval process leads to delays, it leads to late payments to your vendors, which ultimately leads to unhappy vendors.

So how do we fix this? What we like to do…and if this is a new concept or maybe you have an automated process but want to improve it, just start thinking about those types of ways you could improve this. A lot of times we just like to do direct approval assignment. So after an invoice has been coded, or a Non-PO invoice has been coded, it goes into a queue or a process that will reference an approval matrix that you guys kind of define, and we can assign this invoice to that person automatically based on the rules.

Oftentimes that can depend on the department, it can depend on the accounting unit even. If you want to go line by line of an invoice and say, hey, this person has to approve 20% of the invoice or 50% of the invoice and the other person does the rest, those can all be handled. And there’s various methods to do that.

Some of the softwares we work with a person that approves invoices a lot gets their own workflow queue that they just monitor. Other times a task of sorts is assigned to that person, where they get a notification and they’ve got a small form where they basically approve or reject an invoice and they give a reason for why. And, again, these are highly customizable to your guys’ needs.

With these, and, again, this would most likely be stood up in whatever software, whether it’s an ECM or workflow software that you guys have, these approvals would be set up within that system itself and leverage the tools that are available to you there to kind of make this approval process happen on a quick basis.

So, again, it’s a situation where someone’s not manually telling someone, you have to approve this, they are now getting a standardized email, they are now getting a standardized form. It’s the same every single time. And with that because you’re doing it within a system you’re able to track that information, you’re able to see who approved it, who rejected it, why they rejected it, the time and date stamp. These are all things that auditors typically want to know, so we want to make that information available to you guys as well.

Because it’s standardized it is going to be very intuitive to the user as well, so when they get a screen…if I get an email that says, do you approve this, yes or no, and I just have the option to just say yes or no you can basically cut out the middle man a lot of times and just process things a lot faster.

It’s also worth mentioning, whatever system we can oftentimes do this through SMS, through text through an SMS approval app. That’s pretty neat as well, so if you have a need for that it’s usually good for those really high invoices that you don’t really want to bug your CEO or CTO with those kind of invoices.

And the last thing really to mention, because a lot of times clients come to us and say, it’s taking way too long for us to approve invoices, we set up an SLA or escalation process. This can take any shape or form, I’ve seen any number of ways to do this, but typically it’d be like if I assigned Sean an invoice and he didn’t do anything with it for three, five days, he gets a reminder email. After an additional two days it gets escalated to his manager with an email saying, hey, previous person, Sean, did not approve this invoice. There’s ways that you can have a systematic approach to escalate these invoices so that people are aware and people are ultimately held accountable for doing their job when it comes to basically getting these invoices out the door.

Sean LaBonte:

Right, so we have our invoice approved now, now we need to get it over into our ERP. That can look through a couple different ways. So you have your invoice, it’s coded, you have all your lines, it’s been approved, you have various different methods of actually getting it over to your ERP. That can include utilizing existing integrations or ERP software. So, for instance, you mentioned RSO earlier, RSO has a connector built into it that you can connect straight into Dynamics AX, for instance. If you have needs for something custom, we actually have a product called Yoga Connect. It’s a custom connector, it’s been a lifesaver in plenty of other projects that I’ve been on so far, and it’s really just going to be built out to move anything from your ECM to any ERP.

You can also use other existing methods such as direct database calls, open APIs, flat file exchanges, and I also wanted to hit on too, because you were talking about approvals, so there are solutions, specific instances, where you have something like accounts payable invoice automation from Infor. This is built around just a primary workflow that is just for approvals, and it is very fine-tuned and can alleviate all those needs of those manual points that we talked about a couple slides earlier.

Anytime that you take advantage of these automation points it’s going to start reducing time for your payment, this is your biggest ROI here. You can start taking advantage of discounts, vendor discounts, for paying on time or early, for instance. It’s also going to provide you intuitive error handling, for instance, this would be if an invoice has a quantity that’s incorrect. It’s actually going to flag on the form for you or notify an end user that there is an exception here, there’s something that needs to be handled, and it’s going to allow them to take action in a timely instance.

This is going to free up your AP associates to perform more important work where they really need to be. That’s the whole point of automation, right? It’s going to allow end users to start working and focusing on vendor master records, for instance, if you need to update something there, or if you have just exception handlings. That’s really where you want to have a human actually interacting and kind of alleviate all these other stress points that are mundane, tedious tasks that you can actually automate.

Alex Lindsey:

The last piece we’re going to talk, well, not the last piece, but the last piece that’s part of the accounts payable automation process that we’re going to talk about is just the reporting and analytics. This is a very apt meme here. Again, if you don’t have the processes in place or the systems in place to track this information, how would you know how well you’re doing? So invoice line of sight is very important. A lot of the softwares we work with have a lot of accounts payable or invoice processing-specific reports to show you specific things.

Accrual reporting, just built in out of the box. Approval oversight, so you can see everything…one, you can see everything that’s in flight within your system. All right, it’s going through the OCR process now, this is how many are going through that process, this is how many are going through coding, this is how many are sitting with approvals. You get a lot of good insight into where your documents are. This is particularly important at month or year-end close so you can start to monitor and see, all right, here’s the invoices, we’re getting down to the bottom here, so we can close our books for that time period.

And you can also with the OCR technology, the intelligent data capture, there’s extraction results, analytics around how you’re pulling these values. This is actually very important, this is a very empowering type of reports that are included with a lot of the OCR technologies that allow you to see how well that technology is working. How often am I getting the vendor information correct? How often is the invoice date? Which vendor specifically are my users having to go and investigate things all the time. It empowers you to go and potentially make changes to it, either that or basically get improved results through just examining your vendors and asking them to do things slightly differently.

You also have user and workflow statistics as well, so you can get audit histories of the things that they’ve worked on, how many documents have passed through workflow, how long it takes to get your invoices. So it’s a great tracking mechanism to say, it takes me 20 days to pay an invoice now, and then three months after our go-live, well, it only takes me 10 days to pay an invoice now from start to finish. So you get to realize your ROI and really own that process through to the end.

Plus, they’re pretty. A lot of these reporting tools, they look really good. They’re distributable in a number of different ways.

Sean LaBonte:

All right, so kind of lastly here we want to talk about additional automation opportunities. This is going to be something that you can add onto what we’ve already talked about in the existing structure to help alleviate more pain points kind of depending on your own processes. So one key point that I want to bring up here is RPA. It’s a pretty hot term right now, you’ve heard it before probably, it’s robotic process automation. This can help…I like to think of it this way, you’re trying to focus on the low-hanging fruit, the mundane, repeatable task that a processor or a clerk is going to be performing, and you’re trying to alleviate that from them so then they can focus on other opportunities for your process.

So one of those might be EDI retrieval. You can simply just automate the ability to go out to a portal and retrieve EDI documents, maybe alleviate the cost nature there for having those sent to you from one of those vendors. As well you can automate some of your vendor searches, maintenance, and initial setups. So I like to think about a nonprofit scenario where you’re getting a new vendor, you have to actually go in and take a look and validate that this vendor can be nonprofit, for instance.

You can simply build a robot that’s going to go check these three or four websites, submit back to you the results, and that way you can do the check. So instead of spending time on your processor doing that, or whoever it may be, you’ve now allowed a robot to do that to free them up for other tasks. You can also do RPA for vendor master record maintenance. So it can help take a look at all your master records, see if anything needs to be updated there, for instance.

Alex Lindsey:

It can also be used for automated check runs. So whether you use RPA to do this or a scripted process, we’ve done this before where a check run process happens once or twice a week. It takes a lot of time sometimes for the AP clerks to get this process going, so you can automate this process as well. It’s just a matter of going and identifying the system that needs to run, identifying the rules to kick those checks off, sometimes making sure there’s paper in the printer, and essentially just getting those checks out the door.

Sean LaBonte:

All right. Another use case here would be the accounts payable buyer involvement. I think you might have mentioned this earlier a little bit?

Alex Lindsey:

A little bit, yeah.

Sean LaBonte:

Yeah, so, for instance, your accounts payable and your buyers might not have the best communication or even a direct line of communication in some instances, so you might want to have something automated there to actually notify the buyer of an issue with a PO, such as what you talked about a little bit earlier with-

Alex Lindsey:

Right.

Sean LaBonte:

…if a PO amount needs to be increased or something.

Alex Lindsey:

Right. And there’s additional opportunities as well with just form processing. What I mean by that is you can set up forms, so you may have check request forms right now that are on paper, you may have payroll forms that are on paper, payroll correction forms that are on paper, ultimately anything that feeds into your accounting system. Forms can be used to automate that process, and these electronic forms would essentially, if you think about it, would just be a link on a dashboard somewhere internally. If a big user group needs to access it they can go in, they can access it. These forms could have lookups to basically pull information from your accounting system with rules on where it needs to go afterwards, so there’s a lot of good opportunities to use form technology. We use Yoga Forms quite a bit, and these have been found to help clients quite a bit to just bolster up the other parts of their accounts payable team.

And there’s also, a last piece is just the payment information update. We pretty much do this for every accounts payable automation solution, particularly ones where you have a document repository like a Perceptive software or an OnBase by Hyland. Ultimately at the end of the process after you’ve posted the invoice to your accounting system, you’ve cut the check essentially, we hold onto those documents for a day or two and we have a script that runs on a nightly basis and pulls that check information, check number, check date, check amount, and updates that document with those values so that the AP users. A lot of times AP users are getting calls from vendors saying, hey, we haven’t received our payment yet. They can look it up and lookup that invoice and say, oh, actually it got paid on this date, here’s the check number, and this is how much it was for.

Sean LaBonte:

All right, so that’s our presentation on AP automation. I now want to open up the floor to any questions that you guys have been thinking about during our presentation.

Speaker 3:

Hey guys, great presentation. We have just a few questions.

What options do I have for vendor self-service, where they could possible review the status of invoices and payment source, submit tax documentation and things like that?

Alex Lindsey:

There’s a lot of good vendor portals out there. I know ReadSoft has one that’s pretty good that allows your users…I mean, you can either distribute the invoices that way or they can basically track where it is in the system. There’s a lot of very good options out there, a lot of the softwares we use, from Kofax to OnBase by Hyland and Perceptive software. There’s a lot of good options to basically be deployed, as well as Infor as well.

Speaker 3:

Thanks.

Next one is, we are planning on switching financial systems in the next couple of years, is there any reason to spend on implementing automation now?

Alex Lindsey:

Yeah, there definitely is. I mean, there’s a lot of good ways to approach this. We do a lot of projects sometimes where people are either upgrading their system or switching. Data is data essentially, really what we would want to know is, how are we going to be implementing with that current system versus new system? If it’s an open API or a SOA architecture, SOA, service-oriented architecture that can just basically talk to anything, these are really good options because we can essentially have a lookup from the intelligent data capture or a form that could just point to an API. And once you guys switch over to a new one you just switch the direction essentially to that new accounting system if you want.

It’s really just, if you think about it when it comes to data integration the code that we have on the software that we work with is really just a mapping exercise to the accounting data on the back end, whichever one you guys are working with. So it’s just a lot of just lining up with where the data goes.

Speaker 3:

And you can create a more consistent user experience now to avoid that.

Alex Lindsey:

That’s a very good point too. Yeah.

Speaker 3:

Next question is, as a SIS admin I want to get everything up into the cloud, my systems, my documents, my storage. Do I have any options?

Alex Lindsey:

Yes, there are many, many, many options for data. I mean, we work with Cloud Infor now for the accounting system, for the financials there, we work with those quite a bit. In terms of capture email really that’s the best way to do it, but you can also scan. ReadSoft Online I know, and Kofax as well, has the ability to basically capture documents from wherever.

For intelligent data capture ReadSoft Online is the cloud platform that we use for basically OCR and reading that technology. People sometimes think it’s lightweight, but it’s really not. It’s highly scalable. It is cloud-based, so really all the back-end processes are kind of handled by the system itself, and it’s got over 11 years of product experience with just invoice processing, so keep that in mind. We work with OCR technologies a lot, but ReadSoft Online is specific to just invoices, so when you…like, once you get data into ReadSoft Online you can drop it in, throw an invoice in there, and it’s automatically going to try to get those values. For cloud [inaudible 00:35:29].

And there are some great cloud storage options as well for documents themselves and workflows. I’m trying to think of ones like [inaudible 00:35:37] potentially.

Speaker 3:

AWS.

Alex Lindsey:

AWS, yeah. There’s some really good options for taking…for a SIS admin that wants to kind of potentially alleviate some of those responsibilities. And if you’ve got a very heavy on-premises server stack right now that’s just handling all of this information it’s a lot to handle, especially if you have a lot of headcount to manage all that. Moving some of that or all of that, in your case, into the cloud, there’s a lot of really good options. We’d love to talk to you about it.

Speaker 3:

All right, that’s all we got. Thank you.

Sean LaBonte:

All right.

Thank you for attending Webinar Wednesday. The recording of this webinar will be posted online, along with the recordings of all our past webinars, at rpic.com/webinars. If you have more questions or want more information on this topic, or to suggest other topics for the future, please contact us at [email protected].

Alex Lindsey:

And check out some of our additional resources. We’ve got a Knowledge Base that we try to keep up to date as much as possible. Current client issues that they see with the softwares we work with, we like to update that. We mentioned Yoga a couple of times, if you want to check out some of the software pieces that we have there or some of the options like Connect or Forms you can check that out. And of course past webinar recordings. If you’d like to see Sean’s face more that’s the place to go.

Thank you, guys.

Want More Content?

Sign up and get access to all our new Knowledge Base content, including new and upcoming Webinars, Virtual User Groups, Product Demos, White Papers, & Case Studies.

Entire Knowledge Base

All Products, Solutions, & Professional Services

Contact Us to Get Started

Don’t Just Take Our Word for it!

See What Our Clients Have to Say

Denver Health

“RPI brought in senior people that our folks related to and were able to work with easily. Their folks have been approachable, they listen to us, and they have been responsive to our questions – and when we see things we want to do a little differently, they have listened and figured out how to make it happen. “

Keith Thompson

Director of ERP Applications

Atlanta Public Schools

“Prior to RPI, we were really struggling with our HR technology. They brought in expertise to provide solutions to business problems, thought leadership for our long term strategic planning, and they help us make sure we are implementing new initiatives in an order that doesn’t create problems in the future. RPI has been a God-send. “

Skye Duckett

Chief Human Resources Officer

Nuvance Health

“We knew our Accounts Payable processes were unsustainable for our planned growth and RPI Consultants offered a blueprint for automating our most time-intensive workflow – invoice processing.”

Miles McIvor

Accounting Systems Manager

San Diego State University

“Our favorite outcome of the solution is the automation, which enables us to provide better service to our customers. Also, our consultant, Michael Madsen, was knowledgeable, easy to work with, patient, dependable and flexible with his schedule.”

Catherine Love

Associate Human Resources Director

Bon Secours Health System

“RPI has more than just knowledge, their consultants are personable leaders who will drive more efficient solutions. They challenged us to think outside the box and to believe that we could design a best-practice solution with minimal ongoing costs.”

Joel Stafford

Director of Accounts Payable

Lippert Components

“We understood we required a robust, customized solution. RPI not only had the product expertise, they listened to our needs to make sure the project was a success.”

Chris Tozier

Director of Information Technology

Bassett Medical Center

“Overall the project went really well, I’m very pleased with the outcome. I don’t think having any other consulting team on the project would have been able to provide us as much knowledge as RPI has been able to. “

Sue Pokorny

Manager of HRIS & Compensation

MD National Capital Park & Planning Commission

“Working with Anne Bwogi [RPI Project Manager] is fun. She keeps us grounded and makes sure we are thoroughly engaged. We have a name for her – the Annetrack. The Annetrack is on schedule so you better get on board.”

Derek Morgan

ERP Business Analyst

Aspirus

“Our relationship with RPI is great, they are like an extension of the Aspirus team. When we have a question, we reach out to them and get answers right away. If we have a big project, we bounce it off them immediately to get their ideas and ask for their expertise.”

Jen Underwood

Director of Supply Chain Informatics and Systems

Our People are the Difference

And Our Culture is Our Greatest Asset

A lot of people say it, we really mean it. We recruit good people. People who are great at what they do and fun to work with. We look for diverse strengths and abilities, a passion for excellent client service, and an entrepreneurial drive to get the job done.

We also practice what we preach and use the industry’s leading software to help manage our projects, engage with our client project teams, and enable our team to stay connected and collaborate. This open, team-based approach gives each customer and project the cumulative value of our entire team’s knowledge and experience.

The RPI Consultants Blog

News, Announcements, Celebrations, & Upcoming Events

News & Announcements

Prioritizing Employee Engagement: How Healthcare is Meeting the Challenge

Chris Arey2023-10-21T07:10:09+00:00October 17th, 2023|Blog|

RPI Consultants Named one of Modern Healthcare’s Best Places to Work for Third Consecutive Year

Chris Arey2024-05-07T17:52:11+00:00October 11th, 2023|Blog, Press Releases|

Mitigating Losses: How Infor Contract Management Protects Your Organization

Chris Arey2023-10-06T16:35:25+00:00October 3rd, 2023|Blog|

What is Expense Management? A Guide for Financial Control

Chris Arey2023-09-27T14:14:06+00:00September 19th, 2023|Blog|

Unlocking Workforce Efficiency With Multi-View Scheduler

Chris Arey2024-02-26T15:12:00+00:00September 5th, 2023|Blog|

High Fives & Go Lives

Upcoming Events

RPI Sponsors 2-Day Southeast Lawson Mega Meeting

RPI Consultants2024-03-01T11:11:12+00:00May 6th, 2014|Blog, Virtual Events, User Groups, & Conferences|

RPI is Platinum Sponsor at Infor Lawson SouthWest User Group

RPI Consultants2024-03-01T11:04:28+00:00May 6th, 2014|Blog, Virtual Events, User Groups, & Conferences|

RPI Presents at Lawson Mid-America Mega User Group

RPI Consultants2024-03-01T11:05:53+00:00November 18th, 2013|Blog, Virtual Events, User Groups, & Conferences|

RPI Sponsors Infor West Coast “Mega Conference”

RPI Consultants2024-03-01T11:08:47+00:00November 11th, 2013|Blog, Press Releases, Virtual Events, User Groups, & Conferences|

RPI Attends 2013 Inforum Conference

RPI Consultants2024-02-26T13:57:49+00:00April 11th, 2013|Blog, Virtual Events, User Groups, & Conferences|